If you are a veteran who is holding a home loan backed by the Department of Veterans Affairs (VA), you might think that you’re stuck with the loan you have. But that’s not necessarily true. There are a number of options available to veterans with VA Loans, one being the VA IRRRL (Interest Rate Reduction Refinance Loan).

These loans are typically available for a borrower’s primary residence, meaning the property must be the home where you intend to live. The Department of Veterans Affairs is a government agency that backs these loans, providing benefits such as no down payment and no private mortgage insurance. This can give you the power to reduce your interest rates, monthly payments, or switch from an adjustable to a fixed-rate mortgage.

While it’s a good option for veterans who would like to refinance, timing is everything. You have to check the rates. When comparing rates, borrowers should also consider the annual percentage rate (APR), which reflects the true cost of the loan including fees.

Here’s what you need to know about current rates, qualifying criteria, lender comparison, and how to make the most of the refinance opportunity.

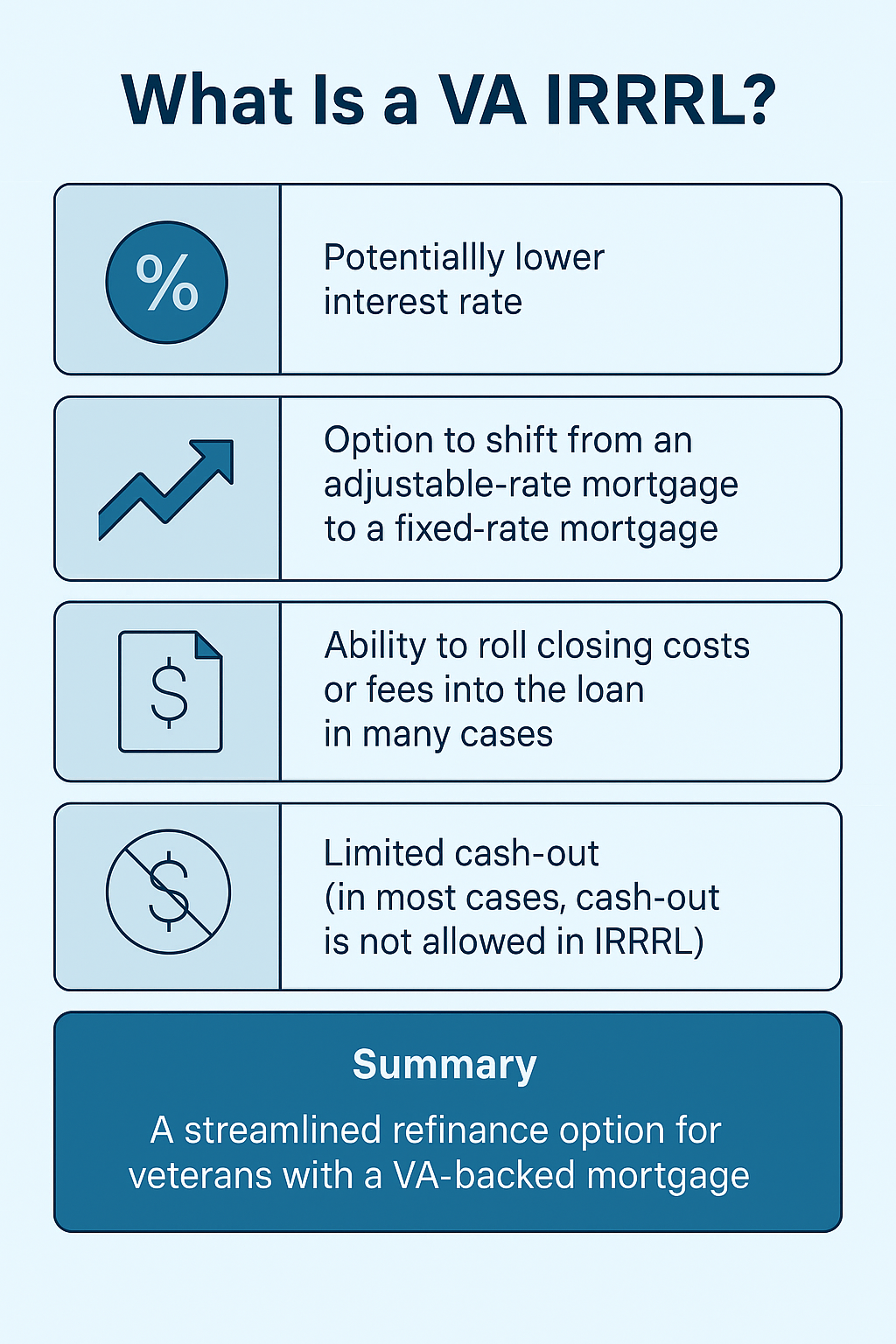

What Is a VA IRRRL (Interest Rate Reduction Refinance Loan)?

A VA IRRRL is a streamlined refinance option available to veterans who already have a VA‑backed mortgage. Because the loan already resides within the VA program, the IRRRL simplifies the process.

Usually, no full appraisal, minimal income verification, and lower funding fees. It’s often called a “VA streamline refinance,” and its primary purpose is to help veterans obtain better terms on a loan they already own.

The VA IRRRL is one of several loan options available to veterans seeking to refinance, so it’s important to compare features and eligibility requirements.

Key benefits include:

- Potentially lower interest rate

- Option to shift from an adjustable‑rate mortgage (ARM) to a fixed‑rate mortgage

- Ability to roll closing costs or fees into the loan in many cases

- Limited cash‑out (in most cases, cash‑out is not allowed in IRRRL)

When you compare the VA streamline refinance rates, you’ll find they often beat many conventional options, especially for qualified veterans, so long as you meet the requirements and timing is right. VA loan rates are generally lower than other major loan types due to the VA backing a portion of each loan. Loan assumptions, such as credit score, loan-to-value ratio, and property type, may also affect eligibility and terms for the IRRRL.

Current VA IRRRL Rates: What Borrowers Need to Know

Just like any interest rates, the VA IRRRL rates change daily, but there have been some reductions in rates more recently. Right now, a major lender lists the current rates at 4.99%, 5.81 APR. As of November 19, 2025, the 30-year fixed VA refinance loan rate is 5.500%. Current refinance rates for VA loans may be lower or higher than previous periods, so it’s important to compare them to historical averages before making a decision.

Keep in mind these advertised rates are “as low as” figures and assume excellent credit, favorable loan‑to‑value (LTV) ratios, and minimal prepayment risk. Mortgage interest rates can vary depending on economic factors and borrower qualifications. The federal reserve’s monetary policy decisions can affect mortgage rates indirectly, as changes in the federal funds rate influence overall market conditions. Additionally, the federal funds rate indirectly impacts VA loan rates by influencing economic growth and inflation expectations. Factors such as credit score, property type, and loan amount can also vary depending on individual circumstances and influence the rate offered.

Chart data is often used to track weekly trends in VA IRRRL rates, helping borrowers visualize rate changes over time. You can use a mortgage refinance calculator to estimate your potential savings and determine if refinancing makes sense for your situation.

When judging whether to refinance, use the VA refinance calculator that many lenders provide so you can estimate your payment reduction and break‑even point on closing costs.

How to Qualify for the Best VA IRRRL Rates Today

To qualify for an IRRRL and secure top rates, you’ll need to meet several key criteria:

- You already have a VA‑backed home loan. The IRRRL is only for refinancing an existing VA loan, not converting a conventional loan into a VA loan.

- The new loan must provide a tangible benefit, typically a lower interest rate, a move from ARM to fixed, or savings over the life of the loan.

- You must certify that you live in, or used to live in, the home securing the loan.

- While documentation is simplified, lenders will still look at your credit score, payment history (especially a clean record on the current loan), property condition, and closing costs.

- Some lenders allow rolling in the VA funding fee (typically about 0.5% of the loan amount for IRRRLs) and closing costs.

- All loans are subject to credit approval, which includes a review of your credit report.

- The loan to value ratio is an important factor in determining eligibility and may affect the maximum allowed loan amount.

- A down payment is generally not required for a VA IRRRL, but may be relevant for other loan types.

- The property must typically be a single family home used as your primary residence.

- The maximum allowed loan amount may be subject to program limits and property type.

- Active duty service members may have additional eligibility benefits.

If you meet these requirements and have a strong credit profile, you’re in a good position to lock in a competitive rate in today’s market.

Top Lenders Offering Competitive VA IRRRL Rates

When comparing lenders, focus not only on interest rate but also on closing costs, points, services, and reputation. The Department of Veterans Affairs does not set the rate for VA loans; private lenders do. Some national lenders known for VA IRRRL programs include:

- USAA: publishes VA IRRRL refinance rates and emphasizes service for veterans.

- Veterans United Home Loans: shows direct rate quotes and categories for VA streamline refinance.

- Freedom Mortgage: highlights IRRRL benefits, simplified process, and low funding fee options.

When requesting quotes, always ask for a rate‑locked commitment, disclose all fees (origination, discount points, funding fee), and check whether the quoted rate is for a certain credit score, LTV, or geographic area.

Consult with a loan officer to better understand your rate options, costs, and whether paying discount points makes sense for your situation. Be aware that certain fees must be paid by the borrower at closing. Before making a decision, carefully review all important disclosures provided by the lender, as these outline essential details about rates, fees, and other loan specifics.

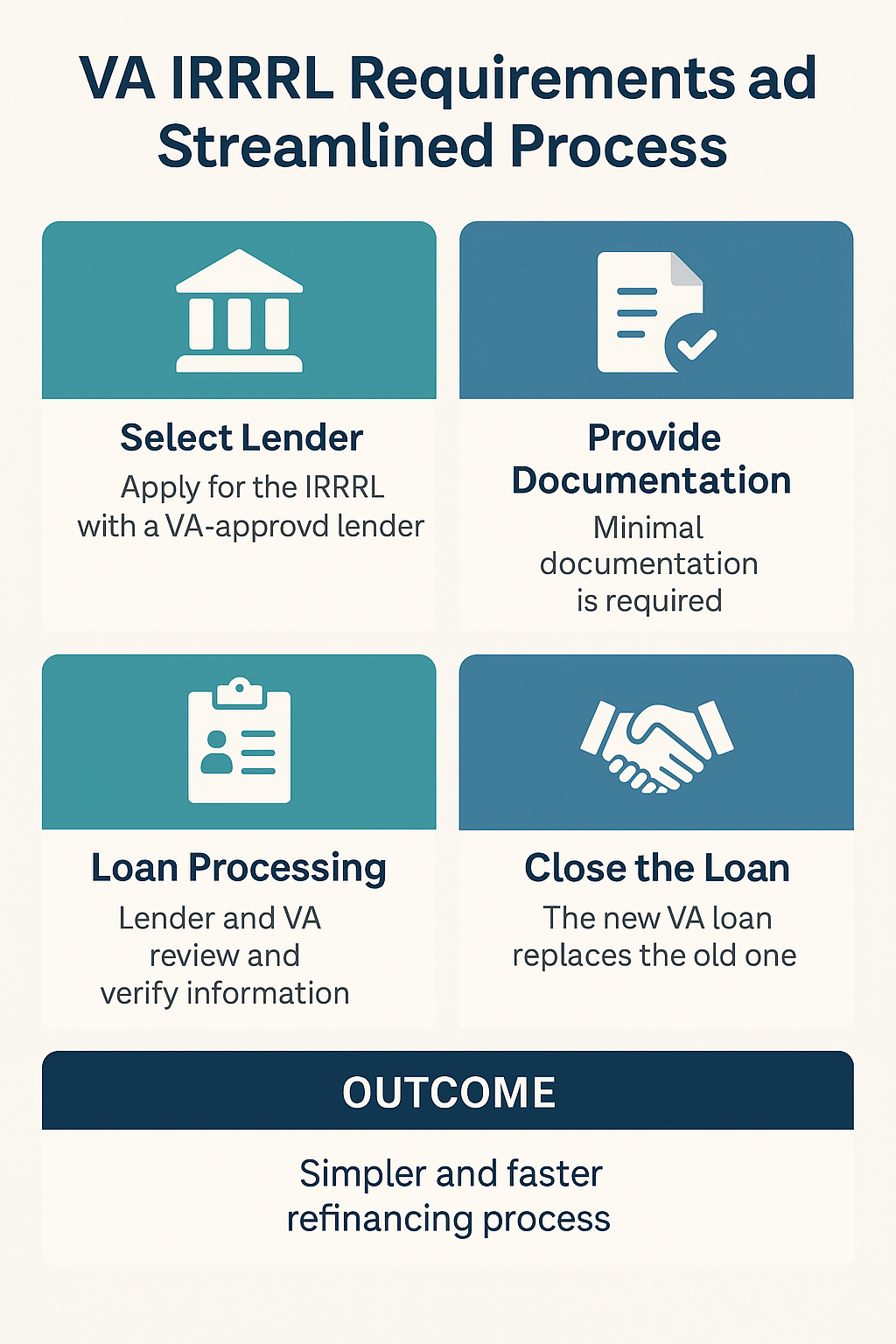

VA IRRRL Requirements and Streamlined Process

The streamlined nature of the IRRRL is one of its most appealing features. The IRRRL is a type of mortgage refinance specifically for VA loans. It can really be done in about four steps. Here’s how the process typically works:

- You select a VA‑approved lender and apply for the IRRRL.

- Minimal documentation is required compared to standard refinances: often no full appraisal nor extensive income verification.

- The lender and VA process the loan based on your existing VA loan, current home value verification (often via an AVM – automated valuation model), payment history, and credit.

- You close the loan, and the new VA‑backed loan replaces the old one. If you’re rolling in closing costs or fees, they are added to the loan amount. This can reduce your home’s equity, since you are increasing your loan balance relative to your property value. Home equity is the difference between your home’s value and your outstanding loan balance.

Pros of the streamlined process include speed, lower paperwork, and typically lower cost. Cons: You cannot take cash out (or you must accept more restrictions), and if rates have not improved much since your original loan, the savings may be minimal.

While the IRRRL does not allow cash out for home improvements, other mortgage refinance options may be available to help you access your home’s equity for renovations or other financial needs.

Pros and Cons of Refinancing with a VA IRRRL

Some of the pros of the process include that it is streamlined and quicker than more traditional channels. You may lock in a lower interest rate and reduce your monthly mortgage payment. Not to mention, you’ll have less paperwork and typically a lower overall cost.

Additionally, you can move from an ARM to a fixed‑rate loan, increasing payment stability. Closing costs and fees may be rolled into the loan, reducing out‑of‑pocket expenses. And there is a simplified underwriting process compared to standard refinance programs.

On the other side, you aren’t able to take cash out a lot of the time. Like many other refinances, savings may also not be noticeable unless rates have drastically changed since you purchased your home.

Another con is that if you extend the loan term, you could pay more interest over time, even if your monthly payment drops. Rolling in fees tends to increase your loan balance and may affect equity.

Lastly, some lenders may charge discount points or higher origination fees. So, you should always compare.

Tips to Lock In the Lowest VA Refinance Rate

To maximize your chance of securing the lowest VA mortgage rates possible, consider these steps:

- Improve or maintain a strong credit score (720+ is often ideal).

- Shorten your loan term if feasible. A 15‑year or 20‑year IRRRL often offers lower rates.

- Avoid negative credit events like late payments or opening new debts in the months before applying.

- Ask multiple VA‑approved lenders for quotes using the same assumptions to compare rates and fees fairly.

- Lock your rate promptly. Market rates can shift based on bond yields, inflation, and economic news.

- Use a VA‑refinance calculator to determine your monthly savings, break‑even point, and total cost over the life of the loan.

FAQs About Best VA IRRRL Rates Today

Taking the steps to refinance your VA loan is an important decision that can have a lasting impact on your finances. Here are some of the most frequently asked questions (FAQs) about finding the best VA IRRRL rates.

- What does “VA streamline refinance rate” mean? It refers to the interest rate you can secure through a VA IRRRL program, which those with existing VA loans can use to refinance under simplified terms.

- How low can a VA IRRRL rate go today? While depending on credit and other factors, lenders’ published examples show rates around 5.375% to 5.500% for 30‑year VA IRRRL as of late 2025.

- Are closing costs required with an IRRRL? Yes, there are closing costs and a VA funding fee (often 0.5% for IRRRLs), but many borrowers roll these into the loan rather than paying out of pocket.

- Can I take cash out with a VA IRRRL? No. The IRRRL is specifically for rate/term refinance of an existing VA loan. If cash‑out is desired, you’d need a different VA loan type, such as a VA cash‑out refinance.

- How quickly can I close a VA IRRRL? Because the process is streamlined and appraisal may be waived, many lenders can close an IRRRL in 30 days or less, assuming your documentation is in order and loan approval proceeds smoothly.

- What are VA rules and how do they affect eligibility and loan terms? VA rules are the specific guidelines set by the Department of Veterans Affairs that determine eligibility, funding fees, occupancy requirements, loan limits, and other program details for VA loans. These rules ensure that only qualified veterans, service members, and certain surviving spouses can access VA loan benefits, and they also outline the terms and protections associated with these loans.

- Are surviving spouses eligible for VA IRRRL or other VA loan benefits? Yes, certain surviving spouses of veterans may be eligible for VA IRRRL and other VA loan benefits if they meet the VA’s eligibility requirements. This includes surviving spouses who have not remarried and whose spouse died in service or as a result of a service-connected disability.

- How does a VA IRRRL compare to conventional loans? VA IRRRLs are only available to eligible borrowers with existing VA loans and typically offer streamlined refinancing with no appraisal or income verification required. Conventional loans, on the other hand, are available to a wider range of borrowers but may require higher credit scores, private mortgage insurance, and more documentation. VA IRRRLs also do not require monthly mortgage insurance, which can make them more affordable than many conventional loans.

Your Next Move Toward Lower Payments

If you’re a veteran with a VA‑backed mortgage and you haven’t refinanced recently, evaluating the best VA IRRRL rates today could help you reduce monthly payments and lock in long‑term financing stability.

Remember: rates are just one piece of the puzzle. Compare lenders for fees, terms, and transparency. When you’re ready to take the next step, visit AllVeteran.com to see how we can help you explore your options!

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.