Whether your military service is about to end or you’ve already left the military, you might have to consider how to protect your loved ones financially with VA life insurance. Your options will largely depend on your circumstances, health, and age.

You may feel that VA life insurance is the best and most reliable option. But that isn’t always the case. A private term life or a permanent life insurance policy may be a better option. That’ll depend on your personal circumstances.

Understanding VA Life Insurance

VA life insurance is designed for veterans of the US military and their eligible family members. The Department of Veterans Affairs offers this program to financially support the families of veterans in the event they pass away.

Veterans Affairs life insurance aims to ensure that any service member and their loved ones may access reliable and affordable life insurance coverage.

VA life insurance program offers several coverage options, like death benefits. Also, it has competitive premiums. This insurance coverage covers various expenses, including outstanding debts, funeral expenses, everyday living costs, and mortgage payments.

It provides veterans and their loved ones additional financial security, ensuring their families receive adequate financial support even during difficult times.

You don’t need to undertake a medical exam or answer medical questions for this insurance program. You can purchase the insurance policy in increments of $10,000 with a maximum of $40,000. However, the coverage has a two-year waiting period before the policy becomes active.

To qualify for the VA Life Insurance coverage, you must meet one of the following requirements:

- You’re a veteran 80 years old or younger with a VA disability score of 0-100%.

- You’re a veteran aged 81 or older, within two years of suffering from a new service-related disability, and you received a new service-related disability after turning 81.

VA Life Insurance recently introduced a similar insurance benefit known as Service-Disabled Veterans Life Insurance (S-DVI). While you can no longer apply for that insurance policy if you already have it, you should keep it.

VA Life and S-DVI are government-sponsored life insurance policies unavailable via private insurance brokers or companies. The VA offers several life insurance options, including:

Term Life Insurance

This health insurance coverage covers a certain number of years and then ends. It covers lost wages and protects a family’s lifestyle for a short period should something happen. Often, as you get older, premium rates for term life insurance go up, and at some point, they become unaffordable. Most VA-sponsored life insurance policies are term life. Term life premiums depend on one’s life expectancy, health, and age. Thus, premiums for veterans who wait until they’re older to get insurance coverage are higher than if one had applied for insurance coverage when they were younger.

Whole or Permanent Life Insurance

Permanent life insurance lasts forever as long as you pay your premiums. While permanent life insurance might cost you more monthly, it may be cheaper over time if you get a reasonable premium rate while young.

Types of VA Life Insurance Policies

Veterans have several options for life insurance, some of which are provided by the U.S. Department of Veterans Affairs, like Veterans’ Affairs Life Insurance and Veterans’ Group Life Insurance.

You can also purchase life insurance via a private insurance company or convert your existing insurance policy to a private policy.

Servicemembers’ Group Life Insurance or SGLI

This VA life insurance program provides permanent life insurance at an affordable and reliable cost for eligible United States military members. Insurance cover is available up to $400,000 in $50,000 increments.

If you convert your SGLI coverage to VGLI within eight months of leaving the military, you don’t have to provide proof of your health status to be eligible for insurance coverage. However, if you apply after eight months and before the end of the one-year-and-four-month window, you most likely have to prove that you’re in perfect health as part of the application process.

Veterans’ Group Life Insurance or VGLI

The VA automatically enrolls all military service members in Servicemembers’ Group Life Insurance (SGLI). This group life insurance coverage can be converted into Veterans’ Group Life Insurance (VGLI) one year and four months after leaving the military.

Via the VGLI coverage, you might be eligible for VA benefits of $10,000 and a maximum of $400,000 in life insurance. However, this largely depends on the type of health insurance policy you were enrolled in before leaving the military. Additionally, you can increase your insurance policy by $25,000 annually every five years up to $400,000 in coverage, or you get to 60 years, whatever comes first.

Service-Disabled Veteran Insurance or S-VDI

The S-DVI policy offers low-cost life insurance alternatives for disabled veterans because of a service-related injury or illness. To qualify for this insurance program, disabled veterans must meet the following requirements:

- Have been rated for a service-connected disability, regardless of their disability rating

- Have left active duty on or after April 25th, 1951, without a dishonorable discharge.

- Apply within two years of receiving a new disability rating from the VA.

- Have documentation to prove they’re in good health, other than the service-connected injury or illness.

Often, S-DVI offers up to $10,000 of coverage. Disabled veterans have to pay a monthly premium rate depending on the specific coverage plan they choose, their age, and the level of coverage they need. Further, you may qualify for the S-DVI supplemental policy if you become totally disabled and can’t work while having a basic S-DVI policy. The supplemental policy provides up to $30,000 as additional insurance coverage.

Veterans’ Mortgage Life Insurance or VMLI

This is a mortgage security insurance program for totally disabled veterans who have a VA grant allowing them to purchase specially adapted housing.

It helps your loved ones pay off the outstanding mortgage balance on the veteran’s adapted housing in the event of your death. This coverage reduces over time as your loved ones pay off your mortgage. The program directly provides up to $200,000 to the lender holding your mortgage.

To qualify for this insurance program, you must meet the following conditions:

- You have the title of your home

- You have a severe and permanent injury or illness that the VA has rated as service-related.

- You have a mortgage on your house

- You have qualified for and received a VA Specially Adapted Housing (SAH) grant to help modify your home

- You are below 70 years old.

VMLI insurance premiums depend on your age, the amount of coverage you require, and your outstanding mortgage balance.

Family Servicemembers’ Group Life Insurance or Family SGLI

This VA life insurance policy ensures that the dependent children and spouses of active duty members of the military are covered under the full-time SGLI.

You might qualify for FSGLI coverage if you’re the spouse or dependent kids of a service member and you meet one of these conditions:

- The serviceperson is a commissioned member of the Ready Reserve or covered by full-time SGLI, or

- The service person is still on active duty and covered by full-time SGLI

You might be eligible for this life insurance plan as the spouse of a person with SGLI coverage, whether retired, still on active duty, or a civilian.

With FSGLI, spouses of service members can get up to $100,000 and $10,000 for each dependent kid.

Traumatic Injury Protection (TSGLI)

Servicemembers’ Group Life Insurance Traumatic Injury Protection, also called TSGLI, offers short-term economic aid to help eligible service members recover from devastating injuries or illnesses. You might qualify for TSGLI if you were covered by SGLI when you suffered a severe injury and you meet these conditions:

- You sustained the devastating injury before midnight the day you left the military,

- You have a scheduled loss that’s a direct result of the devastating injury,

- You were an active-duty military member, a National Guard member, a Reservist, on 1-day muster duty, or funeral-honors duty, and

- You’ve survived for not less than one week from the day you suffered the devastating injury (the one-week period starts on the day and time of the severe injury and ends seven days later).

If you meet all of the above conditions, you might get $25,000 to $100,000 in short-term economic support to help you recover from the devastating injury.

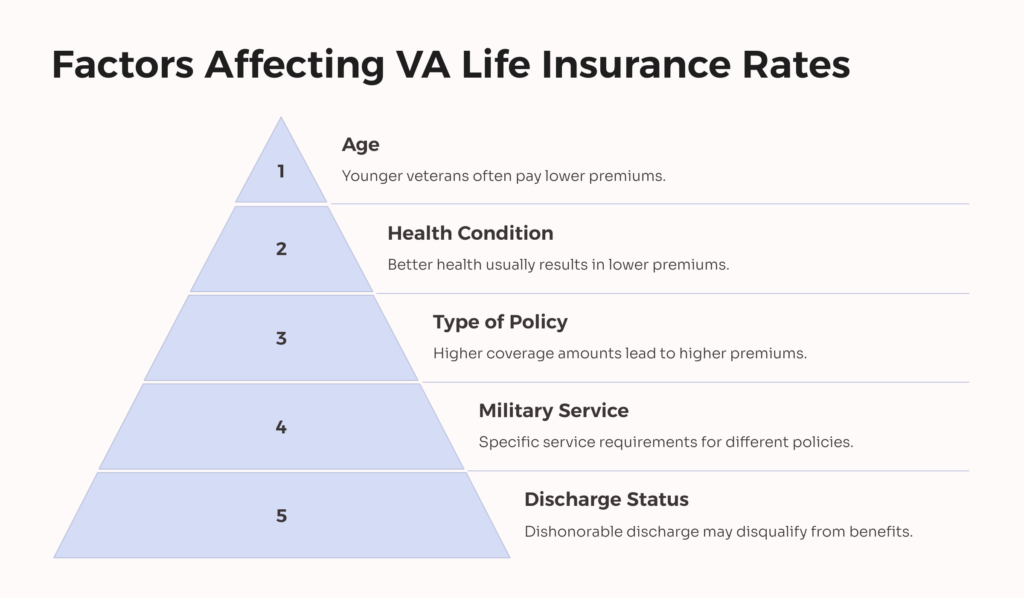

Factors Affecting VA Life Insurance Rates

To qualify for VA life insurance benefits, veterans must meet specific eligibility criteria established by the VA. These criteria determine if a veteran qualifies for VA life insurance coverage. The VA considers these factors before awarding life insurance coverage:

A Veteran’s Age:

Age is a vital determinant. Younger veterans often pay lower insurance premiums because they have a longer life expectancy. Ultimately, this lowers the risk for the VA.

Health Condition:

Health status still plays a significant role in whether you qualify for VA insurance coverage, even though many VA life insurance covers don’t require a medical examination for eligibility. Some severe disabilities or health conditions might affect eligibility for certain policies, including the S-DVI program. Often, good health results in lower premiums. Thus, veterans with better health are deemed a lower risk, so they usually get more affordable insurance coverage.

Type of Insurance Policy:

The kind of VA life insurance you need directly influences premium rates. High coverage amounts result in increased risk for the insurer, which results in higher premiums for veterans needing extensive life insurance protection.

Service in the Military:

You must have served in the U.S. military and meet certain conditions concerning the type and length of service. VA life insurance covers have different service requirements, including specific dates of service or minimum active duty periods.

Discharge Status:

Your discharge status is also vital in determining whether you qualify for VA life insurance benefits. Essentially, veterans with a general discharge under horrible conditions, honorable discharge, or other-than-dishonorable discharge qualify for VA life insurance benefits.

However, you might be ineligible for VA life insurance programs if you have a dishonorable discharge.

VA life insurance rates depend on various factors, including military service, health status, age, chosen policy type, and discharge status. Thus, to make educated decisions about your VA life insurance policy, you must consider these factors carefully.

How to Determine Your VA Life Insurance Rate

Considering your personal circumstances and coverage needs can help you calculate your VA life insurance rates. Here’s a step-by-step guide to help you calculate your VA life insurance:

Evaluate Your Survivors’ Financial Obligations

Your survivor’s financial obligations are any expenses they might have to pay immediately. That includes:

- Health care expenses,

- Estate taxes,

- Burial and funeral expenses, and

- Other estate-settlement costs like legal expenses.

Additionally, financial obligations include what you and your survivors might owe or might need for planned living costs, including:

- Education expenses

- Housing expenses

- Credit card debt

- Home equity

- Car and personal loans

- An emergency fund for unexpected expenses

Determine Annual Income Available to Your Survivors

This includes all the money your survivors will receive or earn every year from social security survivor benefits, VA survivor benefits, a job, dividends, interest, a survivor benefit plan, and other sources like rental properties.

Calculate the Annual Income Your Survivors Need

Your survivors will need an annual income every year. It’s the total amount they need to continue enjoying the lifestyle you want for them. This includes basic needs and luxuries. To calculate that amount, the VA life insurance calculator will ask: How much money do your survivors need each year? It’ll also ask how long they’ll need that money.

Determine Your Survivors’ Assets

Your survivor’s assets are any valuable items that might give them a one-time payment. But, if you have any debt, they may have to use those assets to pay off those debts. Assets include current investments. They include VA education benefits for qualified dependents. Also, they include SGLI, VGLI, or other life insurance benefits.

Consider the above steps. They’ll help you make educated decisions. You can use them to determine your VA life insurance rates. The process encompasses a detailed analysis of personal circumstances. It also entails determining your coverage needs and available life insurance options. Online calculators and tools make determining VA life insurance rates easier. They also help you find affordable and reliable life insurance coverage.

Comparing VA Life Insurance Rates

Veterans seeking VA life insurance coverage have many options to explore, and comparing rates from different insurance providers is a vital step in finding the most suitable and affordable insurance plan. To compare VA life insurance rates from different insurance providers, you need to:

Understand Your Financial Needs

Before you start the comparison process, you should determine your life insurance needs. To determine your financial needs, you must consider factors like financial obligations and outstanding debts. This understanding will guide you in finding the right coverage amount.

Refer to Veteran’s Handbooks and Guides

Education resources, like the VA’s 2024 Life Insurance Program, offer invaluable insights into available insurance options when transitioning from active duty. These resources often compare different life insurance policies, enabling veterans to make educated decisions.

Use the VA Insurance Needs Calculator

The VA provides a reliable Insurance Needs Calculator, allowing veterans to input certain information to determine their VA life insurance needs. This calculator helps veterans determine the coverage needed depending on their unique circumstances.

Explore Various VA Life Insurance Options

VA offers several life insurance options, like SGLI, VGLI, S-DVI, FSGLI, and many others. So, you must familiarize yourself with these life insurance options. You must also understand each option’s premium structures and coverage limits.

Comparing VA life insurance rates entails understanding your financial needs. To compare VA life insurance rates, you’ll need to refer to the veteran’s handbooks and guides. You can also use the VA life insurance needs calculator. The above-mentioned key steps will help you navigate the complicated landscape of VA life insurance and secure an insurance policy that aligns with your financial needs.

Tips for Getting the Best VA Life Insurance Rates

Securing the best reliable and affordable VA life insurance rates is essential for veterans looking to protect their families. Observing practical strategies and tips can help you navigate the insurance landscape better.

Avoid Tobacco Use

Tobacco use affects life insurance premiums significantly. Often, Veterans who don’t use tobacco are likely to qualify for lower insurance rates. Also, quitting smoking before applying for VA life insurance can save you a ton of money.

Maintain Good Health

Good health condition is vital in securing affordable life insurance rates. Thus, you must eat a balanced diet. You should also exercise regularly and have routine medical check-ups. These things will help you maintain good health, lowering your insurance premiums.

Leverage Available Military Discounts

Most insurance companies offer military discounts. They do this to appreciate veterans for their service. Thus, you must explore insurance providers that specifically cater to veterans as a way to lower your insurance rates. These insurers might offer tailored life insurance packages or exclusive discounts for veterans.

Optimize Your Coverage Amount

Finding the right life insurance coverage amount is essential. Thus, you should evaluate your outstanding debts to optimize your insurance coverage amount. Also, you should evaluate your financial obligations and future financial needs. Although adequate insurance coverage is vital. Over-insuring can result in extra costs. So, you must leverage online calculators and tools to find the right coverage amount.

Conclusion: VA Life Insurance Rates

By exploring the different types of VA life insurance policies, you can make educated decisions aligning with your unique circumstances and needs. Whether considering the SGLI, VGLI, or any other VA life insurance policy, understanding the available options is essential for optimal coverage.

At AllVeteran.com, we recognize the service of our veterans to our great country. Thus, we’re committed to offering the exclusive information and resources they need to secure favorable VA life insurance rates that cater to their needs. Click here for the most accurate VA disability rating that your conditions warrant.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.