When a veteran or service member passes away, their legacy doesn’t end—it lives on through the support offered to their loved ones. The VA provides a range of survivor benefits designed to ease the financial and emotional burden during an incredibly difficult time. From monthly compensation and educational assistance to healthcare and memorial honors, these programs are a vital lifeline for eligible spouses, children, and even parents. Yet many families are unaware of what’s available or how to access it. Understanding these VA survivor benefits is a crucial step in honoring your loved one’s service and securing the support you need moving forward. Here is what you need to know.

Understanding Dependency and Indemnity Compensation (DIC)

Dependency and Indemnity Compensation (DIC) is one of the most significant financial benefits available to survivors. This tax-free monetary benefit provides monthly payments to eligible surviving family members.

Who Qualifies for DIC Benefits?

Knowing whether you qualify can be confusing, especially with changing guidelines and multiple eligibility categories. The VA has specific criteria for spouses, children, and sometimes even parents—but many families don’t realize they may be entitled to this support. Here’s a breakdown of eligibility requirements.

- Must have lived continuously with the veteran until their death (or if separated, the separation wasn’t the spouse’s fault)

- Must meet specific marriage duration requirements: married within 15 years of the veteran’s discharge from service where the qualifying condition began or worsened; married for at least one year; or had a child with the veteran

- Remarriage rules: If remarried on or after December 16, 2003, and were 57 or older at the time, or remarried on or after January 5, 2021, and were 55 or older, you may still qualify

The veteran must have:

- Died while on active duty, active duty for training, or inactive-duty training

- Died from a service-connected illness or injury

- Been rated totally disabled due to service-connected conditions for at least 10 years before death, or

- Been rated disabled from discharge for at least 5 years immediately before death, or

- Been rated disabled for at least 1 year before death if they were a former prisoner of war who died after September 30, 1999

For surviving children:

- Must be unmarried

- Under age 18, or under 23 if attending a VA-approved school

- Children who became permanently disabled before age 18 may continue receiving benefits into adulthood

- Even children adopted out of the veteran’s family may still qualify under certain circumstances

For surviving parents:

- Must be the biological, adoptive, or foster parent

- Income must fall below certain VA-established thresholds

- The service member must have died from a service-related illness or injury

DIC Payment Rates for 2025

Whether you’re a surviving spouse or qualified dependent child, familiarity with the 2025 DIC payment rates can help you plan your finances more confidently. Below, we break down the updated figures for different family situations so you can easily see what you’re entitled to receive this year.

For veterans who died on or after January 1, 1993, the base monthly rate for surviving spouses is $1,653.07 (effective December 1, 2024).

Additional amounts may be added based on factors such as:

- If the veteran had a totally disabling rating for 8 years before death

- If the spouse requires Aid and Attendance or is Housebound

- A transitional benefit for the first two years for surviving spouses with children under 18

For veterans who died before January 1, 1993, rates are determined by the veteran’s military pay grade. All DIC payments are tax-exempt, providing significant financial support without tax burden.

The PACT Act and Expanded DIC Eligibility

The Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics (PACT) Act of 2022 has significantly expanded DIC eligibility. Survivors of veterans exposed to burn pits, Agent Orange, and other toxic substances may now qualify for DIC under expanded presumptive conditions.

If you were previously denied DIC benefits, the VA is reviewing denied claims, but you’re encouraged to reapply if you believe you may now qualify under the expanded criteria.

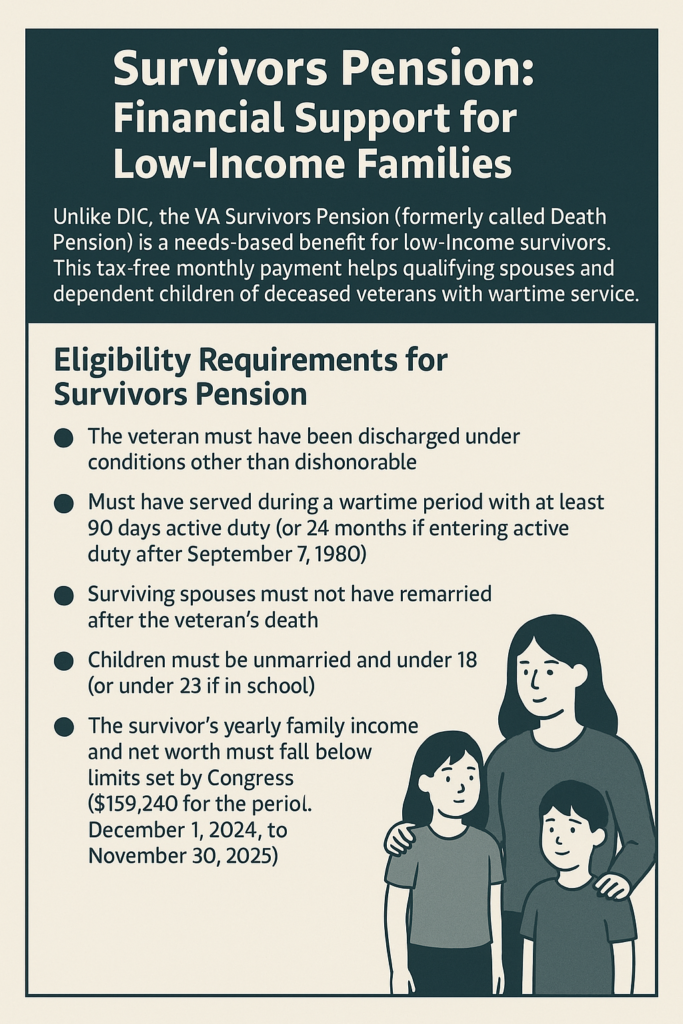

Survivors Pension: Financial Support for Low-Income Families

Unlike DIC, the VA Survivors Pension (formerly called Death Pension) is a needs-based benefit for low-income survivors. This tax-free monthly payment helps qualifying spouses and dependent children of deceased veterans with wartime service.

Eligibility Requirements for Survivors Pension

To qualify for Survivors Pension:

- The veteran must have been discharged under conditions other than dishonorable

- Must have served during a wartime period with at least 90 days active duty (or 24 months if entering active duty after September 7, 1980)

- Surviving spouses must not have remarried after the veteran’s death

- Children must be unmarried and under 18 (or under 23 if in school)

- The survivor’s yearly family income and net worth must fall below limits set by Congress ($159,240 for the period December 1, 2024, to November 30, 2025)

How Pension Rates Are Calculated

The monthly pension payment equals the difference between your countable income and the Maximum Annual Pension Rate (MAPR) set by Congress. Your countable income can be reduced by deducting unreimbursed medical expenses that exceed a certain threshold, potentially increasing your benefit amount.

Asset Transfers and Look-Back Period

Be aware that the VA reviews asset transfers made in the three years before filing a claim. If you transferred assets for less than fair market value during this period, and these assets would have made you ineligible by exceeding the net worth limit, you could face a penalty period of up to five years during which pension benefits won’t be paid.

Additional Support: Aid and Attendance and Housebound Benefits

Both DIC and Survivors Pension recipients may qualify for additional tax-free benefits if they need regular assistance with daily activities or are confined to their home.

This additional monthly payment is available if you:

- Need help with bathing, dressing, eating, or other daily activities

- Are a patient in a nursing home due to mental or physical incapacity

- Have severe visual impairment (5/200 visual acuity or less, or concentric visual field contraction to 5 degrees or less)

- Are substantially confined to your immediate premises due to a permanent disability (Note: you cannot receive both Aid and Attendance and Housebound benefits at the same time)

Education Benefits for Surviving Spouses and Children

The VA provides a range of comprehensive educational assistance programs designed to empower surviving spouses and children as they pursue their academic and career ambitions. These benefits can cover tuition, housing, books, and even vocational training, helping survivors access the tools they need to build a stable and fulfilling future. Programs like the Survivors’ and Dependents’ Educational Assistance (DEA) and the Fry Scholarship are specifically tailored to support those left behind after a veteran’s service. Whether you’re aiming for a college degree, technical certification, or on-the-job training, VA education benefits can ease the financial burden and open new opportunities. With the right support, survivors can turn personal loss into personal growth.

Survivors’ and Dependents’ Educational Assistance (DEA) Program

DEA (Chapter 35) provides education and training benefits to eligible dependents of veterans who:

- Died of a service-connected disability

- Had a permanent and total service-connected disability at death

- Are permanently and totally disabled due to service-connected conditions

- Are missing in action, captured in the line of duty, or held by a hostile force

Eligible individuals can receive benefits for up to 36 months (or 45 months for certain older beneficiaries). These benefits can be used for:

- Degree programs

- Certificate programs

- Apprenticeship

- On-the-job training

There are age limitations for children (generally between 18 and 26) and time limits for spouses (generally 10 years from the veteran’s death, or 20 years if the veteran died on active duty).

Marine Gunnery Sergeant John David Fry Scholarship

This scholarship provides Post-9/11 GI Bill benefits to the children and surviving spouses of service members who died in the line of duty on or after September 11, 2001.

Fry Scholarship benefits include:

- Payment of tuition and fees (up to the in-state maximum at public universities)

- Monthly housing allowance

- Books and supplies stipend

Unlike DEA, a surviving spouse’s remarriage does not terminate Fry Scholarship eligibility if the remarriage occurred under the same age conditions as DIC eligibility. Fry Scholarship recipients can also receive DIC concurrently, although children over 18 receiving DIC will lose DIC eligibility upon using the Fry Scholarship (spouses can receive both).

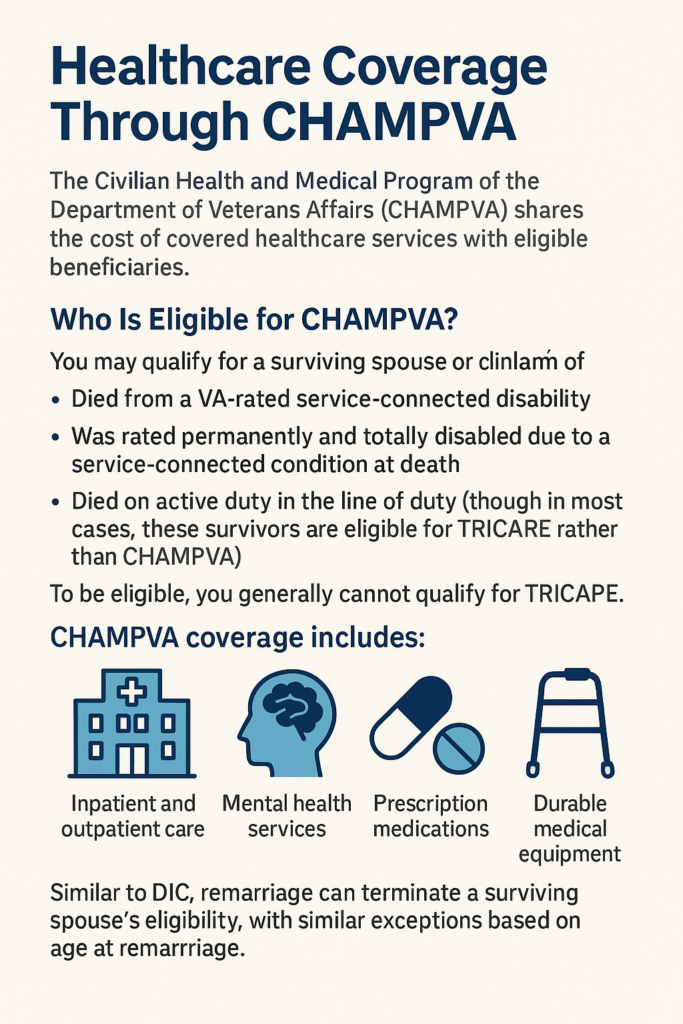

Healthcare Coverage Through CHAMPVA

The Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) shares the cost of covered healthcare services with eligible beneficiaries.

Who Is Eligible for CHAMPVA?

You may qualify for CHAMPVA if you’re the surviving spouse or child of a veteran who:

- Died from a VA-rated service-connected disability

- Was rated permanently and totally disabled due to a service-connected condition at death

- Died on active duty in the line of duty (though in most cases, these survivors are eligible for TRICARE rather than CHAMPVA)

To be eligible, you generally cannot qualify for TRICARE. CHAMPVA coverage includes:

- Inpatient and outpatient care

- Mental health services

- Prescription medications

- Durable medical equipment

Similar to DIC, remarriage can terminate a surviving spouse’s eligibility, with similar exceptions based on age at remarriage.

Burial and Memorial Benefits

The VA provides a meaningful array of burial and memorial benefits designed to honor a veteran’s service and ease the burden on their loved ones. These benefits include burial in a national cemetery, headstones or markers, Presidential Memorial Certificates, and financial assistance for burial expenses. Each element serves as a lasting tribute to the veteran’s sacrifice while offering families dignity, recognition, and support during a difficult time. Whether choosing a VA national cemetery or making private arrangements, families can rely on the VA to provide respectful and thoughtful memorial services. Here is what you need to know about these benefits.

Burial in VA National Cemeteries

Eligible veterans, their spouses, and dependent children can be buried in a VA national cemetery at no cost to the family. Benefits include:

- The gravesite

- Opening and closing of the grave

- Perpetual care

- Government headstone or marker

- Burial flag

- Presidential Memorial Certificate

Spouses and children are typically buried in the same gravesite as the veteran.

Burial Allowances and Reimbursement

The VA may provide financial assistance to help cover funeral and burial expenses:

Service-connected burial allowance is paid when the veteran died from a service-connected disability, with no time limit to apply.

Non-service-connected burial allowance may be paid if the veteran was receiving VA pension or compensation at death, or died while receiving VA care under specific circumstances. Application must generally be submitted within two years of the veteran’s death.

The amount varies depending on whether the death was service-connected and the burial location (VA national cemetery vs. private cemetery).

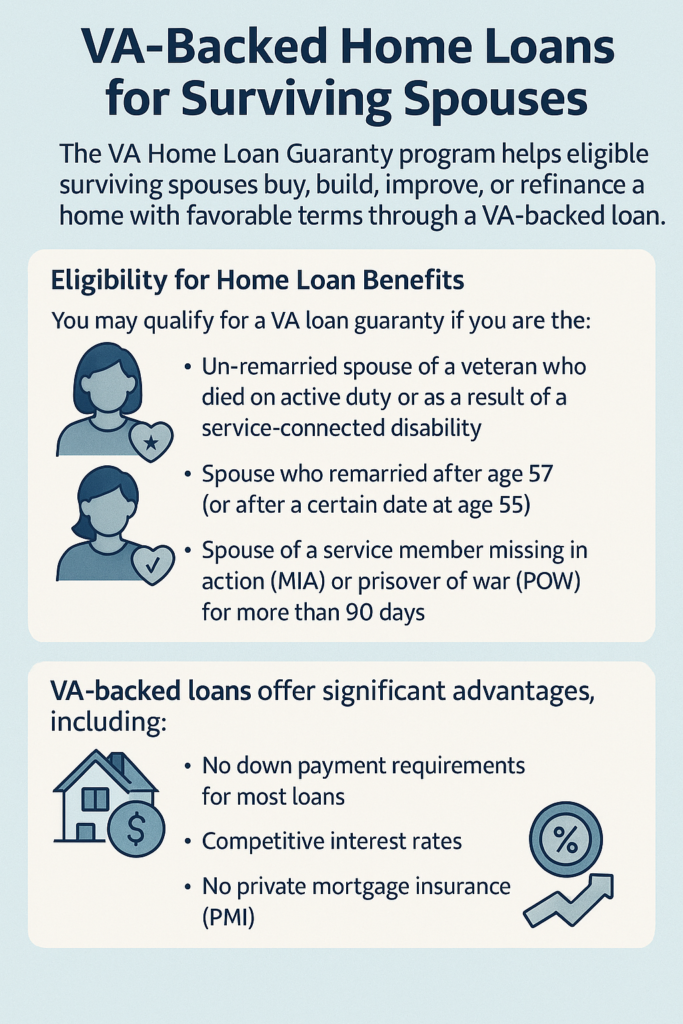

VA-Backed Home Loans for Surviving Spouses

The VA Home Loan Guaranty program helps eligible surviving spouses buy, build, improve, or refinance a home with favorable terms through a VA-backed loan.

Eligibility for Home Loan Benefits

You may qualify for a VA loan guaranty if you are the:

- Un-remarried spouse of a veteran who died on active duty or as a result of a service-connected disability

- Spouse who remarried after age 57 (or after a certain date at age 55)

- Spouse of a service member missing in action (MIA) or prisoner of war (POW) for more than 90 days

VA-backed loans offer significant advantages, including:

- No down payment requirements for most loans

- Competitive interest rates

- No private mortgage insurance (PMI)

Accrued Benefits: Claiming What Was Due

Accrued benefits are monetary benefits that were due to the veteran at death but not yet paid, including pending claims that would have been approved or recurring payments not yet disbursed.

Eligible survivors—typically the surviving spouse, then children, then parents—may claim these benefits for a retroactive period not exceeding two years prior to the veteran’s death.

A claim for Survivors Pension or DIC automatically includes consideration for any available accrued benefits.

Additional Support Services

In addition to financial assistance, the VA provides a wide range of supportive services aimed at helping survivors navigate life after loss. These resources go beyond monthly payments, offering emotional, practical, and long-term guidance to surviving spouses, children, and parents. Here are some of the additional support services available.

Bereavement Counseling

VA Vet Centers provide bereavement counseling to parents, spouses, and children of service members who died on active duty. Counseling is also available through VA medical centers to immediate family members of veterans who died unexpectedly or while receiving VA hospice care.

Life Insurance Benefits

The VA administers several life insurance programs including Servicemembers’ Group Life Insurance (SGLI), Veterans’ Group Life Insurance (VGLI), and Family Servicemembers’ Group Life Insurance (FSGLI). Eligible beneficiaries can file claims for death benefits.

Planning Resources

The “Planning Your Legacy: VA Survivors and Burial Benefits Kit” helps veterans and families organize important documents needed for future benefit claims.

State-Level Benefits

Many states offer their own benefits to survivors, often supplementing federal VA benefits. For example, Virginia’s Military Survivors and Dependents Education Program (VMSDEP) provides education benefits to qualified survivors. Check with your state’s veterans affairs office for state-specific programs.

Understanding Benefit Interactions

It’s important to understand how certain benefits interact:

- DIC vs. Survivors Pension: You cannot receive both simultaneously. The VA will pay whichever benefit provides the greater amount.

- Survivor Benefit Plan (SBP) and DIC: As of January 1, 2023, the SBP-DIC offset has been fully eliminated. Eligible survivors can now receive full SBP payments from the Department of Defense and full DIC payments from the VA concurrently.

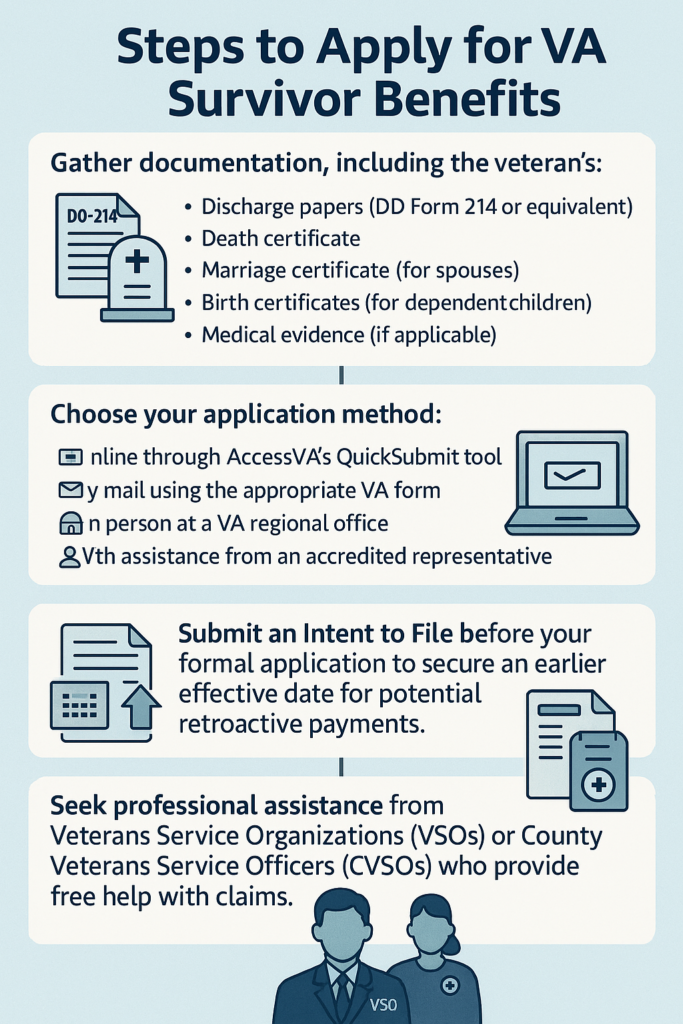

Steps to Apply for VA Survivor Benefits

- Gather documentation, including the veteran’s discharge papers (DD Form 214 or equivalent), death certificate, marriage certificate (for spouses), birth certificates (for dependent children), and medical evidence (if applicable).

- Choose your application method. You can submit it online through AccessVA’s QuickSubmit tool, by mail using the appropriate VA form, in person at a VA regional office, or with assistance from an accredited representative.

- Submit an Intent to File before your formal application to secure an earlier effective date for potential retroactive payments.

- Seek professional assistance from Veterans Service Organizations (VSOs) or County Veterans Service Officers (CVSOs) who provide free help with claims.

Receiving the Benefits You Deserve

VA survivor benefits offer more than just financial assistance—they provide a foundation of support and recognition for the families of those who served. Knowing what you’re eligible for and how to apply is key to receiving the full range of benefits your loved one earned through their sacrifice.

While the system can feel complex, you don’t have to face it alone—trusted resources, including VSOs and VA representatives, are there to guide you every step of the way. Taking action now ensures that you and your family receive the care, stability, and respect you deserve. By navigating the process with confidence, you’re honoring your loved one’s legacy while securing a stronger future.

Let us help you at Allveteran.com. Start today by finding your rating with our free medical evidence screening!

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.