Veterans benefits are privileges extended to those who have served in the military. This veterans service isn’t limited to the veterans but also extends to their spouses or dependents under certain conditions. One often questioned condition is the duration of the marriage to the veteran. Here we’ll go over the influence of the length of marriage on spouses’ eligibility for VA benefits.

Understanding Veterans Benefits

Veteran benefits are a broad cluster of programs and services offered by the U.S. Department of Veterans Affairs (VA). These benefits ensure comprehensive support for veterans and their families to lead a comfortable life post-service. There are four main categories: compensation, education & training, life insurance, home loans, and healthcare. These benefits aren’t only restricted to veterans but also extend to their dependents, survivors, and caregivers.

Marriage Duration and Eligibility

It’s necessary to understand that the duration of marriage significantly influences a spouse’s eligibility for benefits. For many VA benefits, there is no set marriage length requirement. For instance, spousal benefits for VA disability benefits, Survivors’ Pension, and VA health care aren’t determined by the marriage duration. However, for dependency and indemnity compensation (DIC), a spouse must have been married to the veteran for at least one year before the veteran’s death.

Remember that these marriage duration qualifications are in place for veteran spousal benefits to ensure that the relationship is stable and longstanding, minimizing the risk of fraudulent claims. It serves as a measure to protect the integrity of the benefits system and ensure that they reach those who genuinely deserve them.

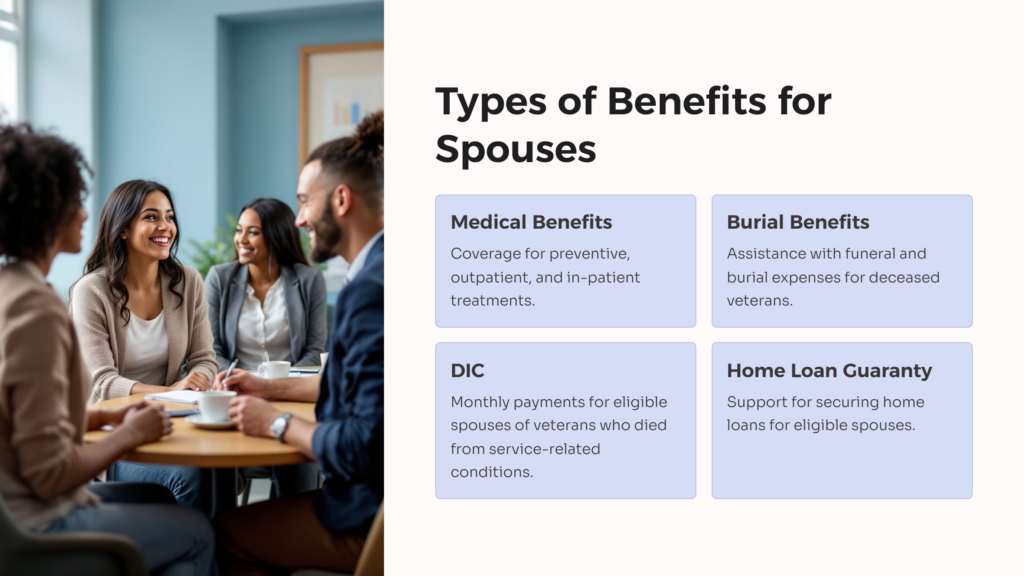

Types of Veteran’s Benefits Available to Spouses

As a spouse of a veteran, several benefits can be accessed such as medical benefits, burial benefits, Dependency and Indemnity Compensation, Home Loan Guaranty, and many more.

VA medical benefits offer coverage for preventive, outpatient, and in-patient treatments. These benefits can be crucial in providing healthcare support for a surviving spouse. Burial benefits, on the other hand, assist in covering the funeral and burial expenses of the deceased veteran.

DIC

Dependency and Indemnity Compensation (DIC) provides monthly payments to eligible spouses who have lost their spouse due to service-related conditions. Along with monthly support, the DIC also offers educational benefits and home loans with the Home Loan Guarantee Program to help spouses secure a home.

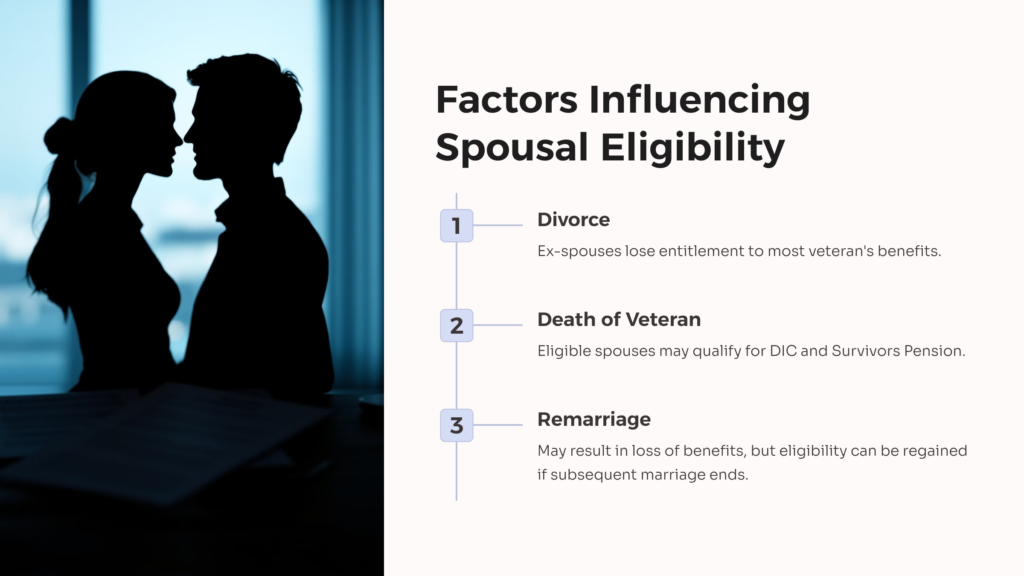

Factors That Can Influence Spousal Eligibility

Numerous factors can influence a spouse’s eligibility for veteran benefits. For instance, in case of divorce from the veteran, the ex-spouse loses all entitlement to the veteran’s benefits. However, if a divorced spouse had earlier secured a VA home loan, they can still retain their eligibility for that specific benefit. Upon the death of the veteran, eligible spouses may still qualify for certain benefits such as Dependency and Indemnity Compensation and Survivors Pension. On remarriage, a spouse may lose their eligibility for certain benefits but can regain them if the subsequent marriage ends due to divorce or death.

Benefits Available to Children of Veterans

Children of veterans are also eligible for certain benefits provided by the VA. These benefits are offered as support as the children continue to grow. These benefits include educational assistance, healthcare coverage, and home loan guarantees.

The VA offers educational benefits, such as:

- Post-9/11 GI Bill, which provides financial aid for college

- Survivors’ and Dependents’ Educational Assistance (DEA) program, for children of veterans who have a service-connected disability or have died while on active duty

- Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) offers comprehensive health insurance for eligible dependents

- VA Home Loan Program, which helps applicants get loans and understand the terms and conditions for purchasing, building, or refinancing a home

VA benefits are not only available to children of a deceased veteran. Children of veterans may be eligible for benefits such as educational assistance, healthcare coverage, and home loan guarantees while their veteran parent is still alive. For this reason, it is important to be aware and take advantage of the resources that are there for your children, right now! Eligibility requirements and specific benefits may vary, so it is advisable to consult with the VA or visit their official website for detailed information.

Steps to Apply for Veterans Benefits as the Spouse

As someone who is married to a veteran, there are steps you need to take to apply for benefits. Paying attention to the steps that need to be completed can help you make sure your claim goes more smoothly. Here is what you need to do.

1. Gather the necessary paperwork. These documents will include VA forms, marriage certificates, SSNs, and evidence of the veteran’s military service.

2. Fill out the VA Form 21P-534EZ, the Application for Dependency and Indemnity Compensation.

3. Submit it along with the necessary documents to your local VA office.

In complex cases, legal advice might be necessary to assist in the application process.

Clearing Misconceptions about Benefits and Marital Duration

Misconceptions about VA benefits and marriage length are common. Many believe that the longer a marriage lasts, the more benefits a surviving spouse can claim, but that’s not always true. While marital duration can affect eligibility, the veteran’s disability rating or cause of death often carries more weight in determining benefit amounts. Understanding these distinctions is key to ensuring you receive the full support you’re entitled to. If you’re unsure about your eligibility or need help navigating survivor benefits, visit AllVeteran.com for a free evaluation and expert assistance tailored to your situation.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.