As we delve into the realm of student loans and the issues associated with their repayment, a unique category surfaces – VA student loan forgiveness. This term refers to certain programs aimed at relieving the financial burden on those who have served the country and are now facing the challenge of financial debt through student loans. The significance of this discussion is multi-faceted, especially for veterans who may not be aware such an option exists and are grappling with student loan repayment.

Why Debt Forgiveness Is Crucial

A student loan essentially functions as a financial aid offered to students to assist them in paying for their post-high school education expenses. Opting for student loans allows individuals access to higher education, which otherwise might have remained unattainable due to financial constraints. However, Student debt can hinder veterans’ futures by creating financial burdens that limit their ability to pursue post-military careers, start businesses, or invest in further education. It can also lead to stress and impact their overall well-being and quality of life after service.

A significant portion of the working public, including veterans, often struggles with paying back their student loan debts—owing to high interest rates or income challenges. Hence, we come across a pressing issue that demands crucial consideration.

Veterans, in basic terms, are individuals who have served their country by being part of the military forces, and have since retired or been discharged. The connection between the veteran status and escalating education costs stems from the fact that many veterans return to school to commence a new career after their service ends, ultimately leading them into the domain of student loans.

Veterans seeking higher education is not an unfamiliar scene. College education is crucial for veterans as it offers them an opportunity to enhance career prospects and personal development after their military service. Despite certain programs aimed at supporting their education, like the GI Bill, they may fall short of covering all costs and still necessitate student loans. On top of financial trouble, most veterans will also face challenges such as adjusting to civilian life, dealing with potential mental health issues, and juggling work and studies. To put things in perspective, a significant share of veterans is beleaguered with student loan repayment. This situation signifies a troubling linkage between veterans and student loans.

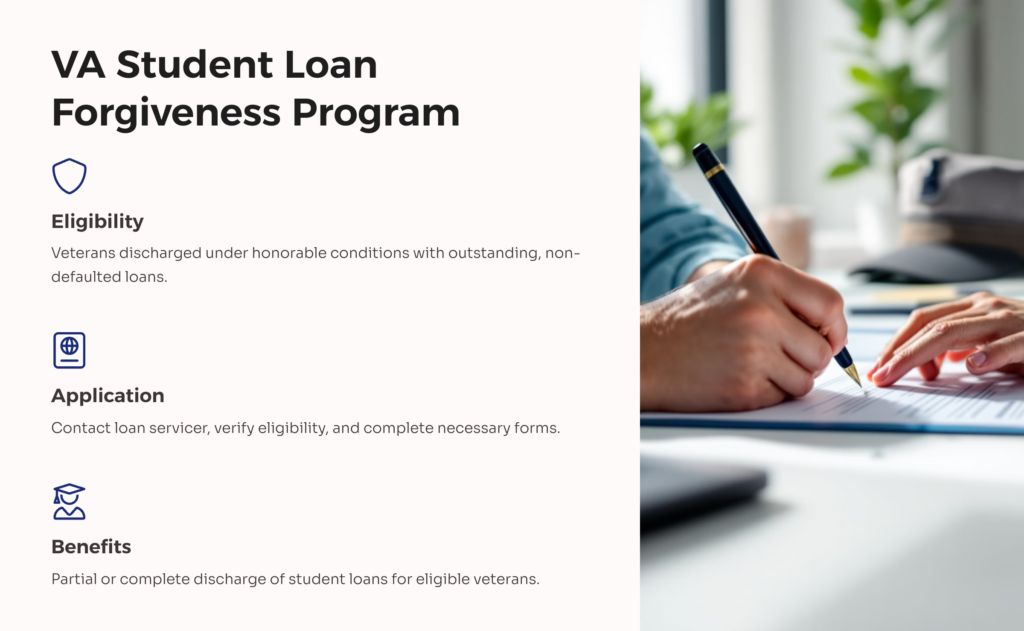

Repayment assistance or forgiveness can be seen as a beacon of hope for distressed veterans. This program entails a complete discharge or partial forgiveness of student loans for eligible veterans. Devised under the “Higher Education Act,” the VA student loan forgiveness program exists to assist veterans who are burdened with educational loans, and give them a financially stable living post-retirement or discharge.

Eligibility Criteria

For any veteran to qualify for VA student loan forgiveness, certain criteria must be met. The primary requirement is that the applicant should be a veteran who has served and has been discharged under honorable conditions. Furthermore, the veteran should have outstanding student loans that have not been defaulted upon. However, those who have already declared bankruptcy or have used up their GI Bill benefits might be rendered ineligible.

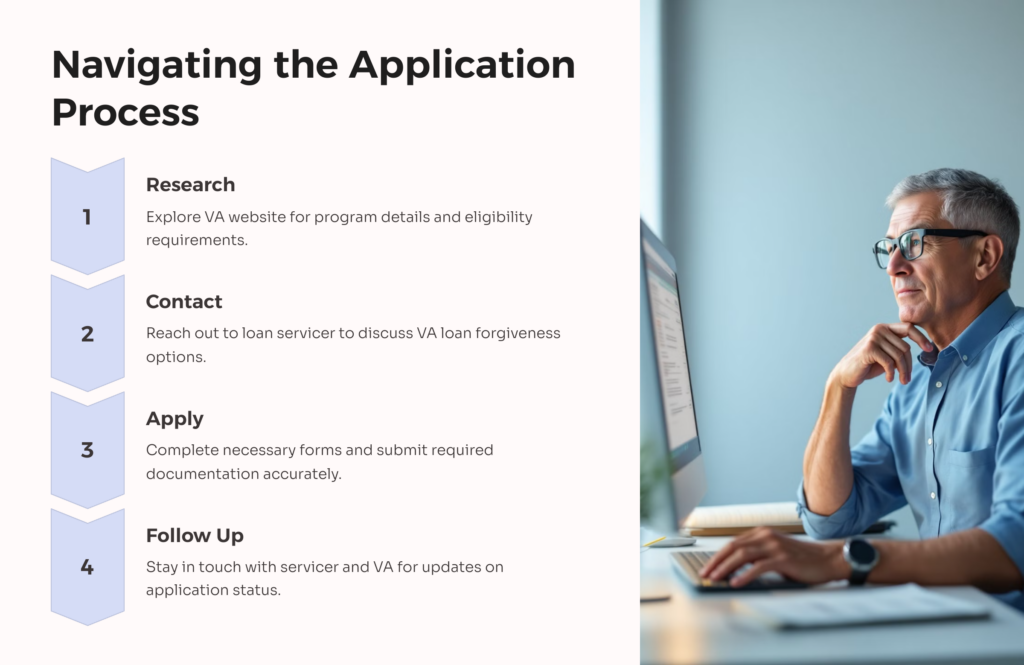

How to Apply for VA Student Loan Forgiveness

The application process for VA loan forgiveness is both straightforward and systematic. It starts with contacting the loan servicer to discuss the possibility of VA loan forgiveness and to verify eligibility. Necessary forms and documents should be filled out correctly, in adherence to the guidelines provided. There are several resources available online for veterans to commence their application process, the most prominent one being the official VA website.

Other College Affordability Options for Veterans

It’s worth acknowledging that the VA student loan forgiveness is not the sole financial aid source for veterans. Additional aids such as scholarships, grants, and various other forgiveness programs targeting specific service activities exist. Veterans may also look into options like the Yellow Ribbon program or the Military Tuition Assistance program. These programs can often be used in combination to minimize the financial load of higher education.

The Yellow Ribbon program is an agreement between a college and the VA to cover tuition expenses that exceed the highest public in-state tuition rate which is the cap the Post-9/11 GI Bill usually covers. The college and VA partner to split the remaining costs not covered. This allows veterans to attend higher-priced private institutions more affordable if the college participates in the program. Over 5,000 degree-granting institutions of higher learning participate currently.

The Military Tuition Assistance program provides financial assistance to active duty or drilling National Guard/Reserve service members to fund college courses and certificate programs during off-duty hours. Each military branch administers their own TA program and establishes annual caps on assistance so combining TA with other education benefits can further reduce out-of-pocket education costs. Applicable careers gained through this aid may also qualify for additional student loan forgiveness incentives down the road as well.

Finding Success With Loan Forgiveness

The benefits of VA student loan forgiveness extend beyond mere monetary relief. Looking at success stories, we find many veterans endorse it for releasing them from the shackles of debt and affording them peace of mind. In several case studies, it is observed that forgiveness significantly impacts veterans’ lives, enabling them to focus on their post-retirement goals rather than be burdened by financial struggles.

Overall, we can see that the VA student loan forgiveness program can be exceptionally beneficial for veterans, freeing them from the confines of educational debts. For veterans grappling with student loan debt, this program offers a viable solution. The benefits of this program extend far beyond simple debt relief, potentially enabling veterans to realize their goals post-service without the added stress of educational finances. It is a step toward acknowledging their sacrifice and valuing service to the country.

Find out more about how the VA might help you, and take advantage of our site to be sure you have access to every benefit for which you qualify. Take our quiz at AllVeteran today to start your new life!

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.