Owning a home has long been seen as a mark of personal success and financial stability in the US. But it isn’t always easy to achieve, and with housing costs on the rise, many still hoping to buy their first home may struggle to do so with a traditional mortgage.

If you’re a military veteran, you may qualify for a VA home loan, potentially making it easier to turn the dream of homeownership into a reality. VA home loans are available to qualified veterans, active duty service members, and certain military families, recognizing the sacrifices made through military service.

The Department of Veterans Affairs backs the VA loan program, providing significant financial benefits to those with military service. VA loan benefits include cost savings and special features that set them apart from other mortgage options.

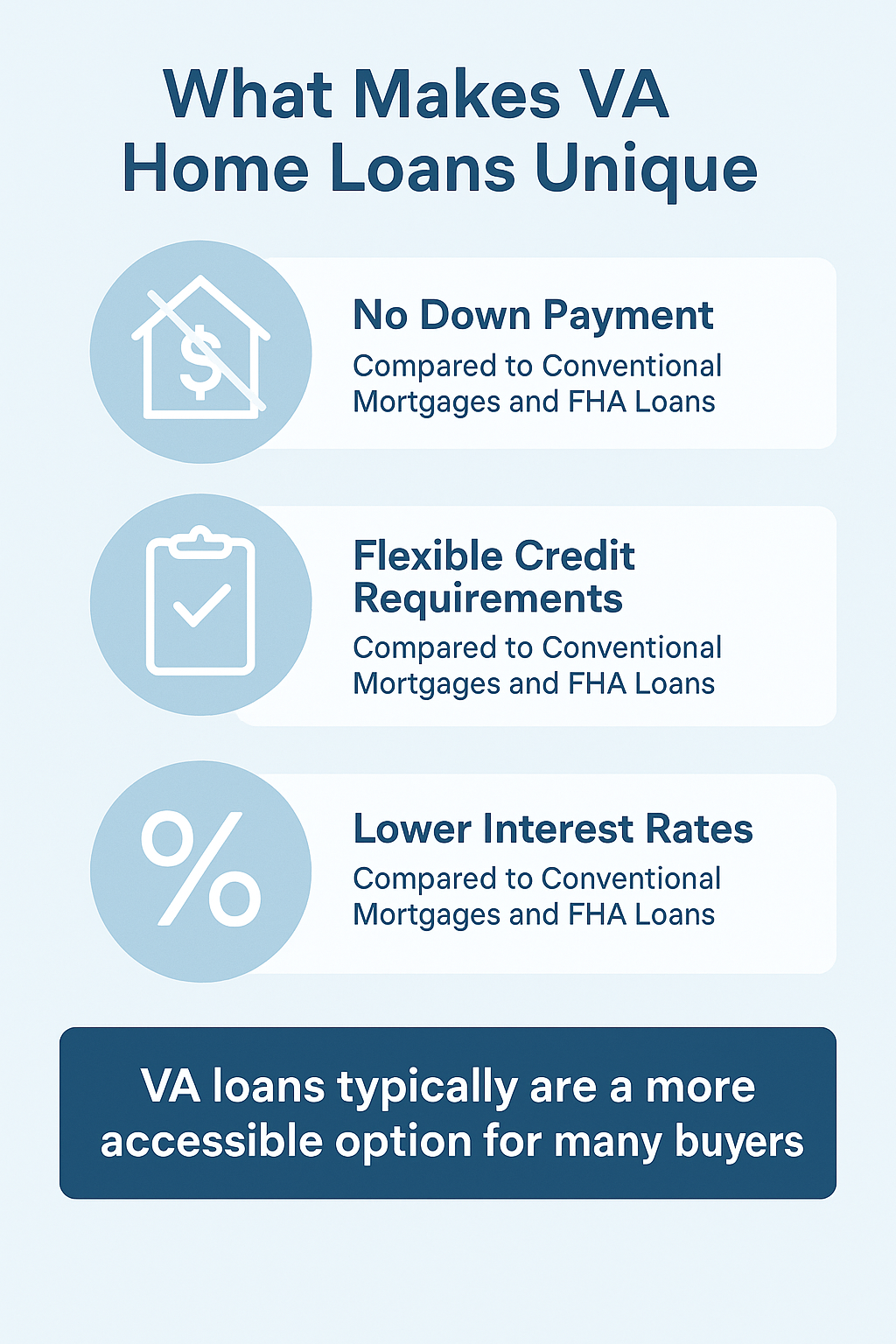

What Makes VA Home Loans Unique

When buying a home, especially when doing so without any equity in another property, there are at least three major obstacles in the way:

- Downpayment requirements

- Credit score concerns

- Mortgage percentages (and their resulting impact on monthly payments)

Compared to conventional mortgages and FHA loans, VA loans typically require no down payment and have more flexible credit requirements, making them a more accessible option for many buyers.

In decades past, prospective homebuyers would usually address these issues with tactics like picking a “starter home” (i.e. a modest, low-cost property they could use to build equity), getting a more established family member to co-sign, tapping into savings/family contributions to cover downpayments, etc.

Those are still options, but escalating property values compared to average income rates has made them less effective as they once were.

Now, for many looking to transition from “renter” to “homeowner,” their ability to close on a home depends heavily on securing a low interest rate, minimizing or eliminating the need for a downpayment, and maintaining gainful employment despite a rapidly fluctuating job market. VA loans often offer competitive interest rates compared to conventional loans, helping buyers save on monthly payments.

The VA loan program can help with some of these issues, lowering barriers to entry and helping veterans finance a home purchase via a mortgage with much more favorable terms. The VA loan program is specifically designed to make homeownership more accessible for veterans. Let’s look at some of these advantages more closely, including VA loan benefits like lower loan related closing costs and more flexible qualification terms than most VA lenders and conventional and FHA loans.

No Down Payment Requirement

One of the biggest advantages to a VA loan is how most of them don’t require a down payment.

Unlike traditional loans, which typically have a minimum down payment requirement, conventional loans and FHA loans usually require a down payment, and both often require annual mortgage insurance and an upfront mortgage insurance premium. VA loans only require down payments when the loan amount exceeds standard benefit allotments. And even then, they are typically lower than standard down payments.

Considering that the average home price in the US in 2025 is over $460,000, skipping on the down payment is a big deal. The purchase price of the home directly impacts the required down payment for conventional and FHA loans. Just 5% of that average price is $23,000. Most first-time homebuyers are expected to pay at least 9%, with some loans requiring as much as 20% or more, forcing buyers to bring anywhere from $41,000 to $92,000 to the table just to qualify.

In other words, just by removing or minimizing the down payment requirement alone, VA loans often help veterans achieve homeownership when they might otherwise never be able to. Just remember, loan limits and maximum loan amounts may affect the need for a down payment.

Lower Interest Rates and Monthly Payments

The downside of skipping down payments, of course, is that monthly payments and interest rates tend to be higher. Especially when the buyer lacks a near-perfect credit score, a home buyer can easily set themselves up for future financial frustrations by getting into a home with too high a housing cost.

VA loans help with that, too. VA buyers benefit because VA loans offer competitive interest rates, and buyers can use discount points to further reduce their rates as part of closing cost negotiations. The VA guarantees some of the value of the loan through the VA loan guaranty, reducing the risk faced by the lender and thereby allowing them to offer better terms to the veteran. As part of this program, a VA funding fee is typically required to help sustain the program, though some VA buyers may be exempt from paying this fee. It’s similar in concept to subsidized student loans, and better for the borrower for the same reasons.

VA loans generally do not require mortgage insurance, and monthly payments are more manageable. Additionally, VA loans do not have a prepayment penalty or prepayment penalties, giving borrowers flexibility to pay off their loan early without extra costs.

Loan assumptions are also possible with VA loans, allowing new buyers to take over existing favorable loan terms.

No Private Mortgage Insurance (PMI)

Another way that VA loans help limit the costs to the borrower is by removing the requirements related to insurance, which are otherwise standard for nearly all mortgages. This is, again, tied to the amount of risk the lender faces, and the steps they typically take to mitigate those risks. Compared to other loans, such as FHA loans and conventional loans, VA loans do not require mortgage insurance costs. FHA loans, for example, require both an upfront mortgage insurance premium paid at closing and annual mortgage insurance that lasts for the life of the loan, which can significantly increase the total cost for borrowers.

With traditional loans, buyers aren’t just paying for the principal and the interest, plus closing costs. They’re also paying for several other included fees, such as insurance. FHA loans require both annual and upfront mortgage insurance premiums, increasing the total cost compared to VA loans. Most mortgages have stipulations regarding when the insurance can be removed (usually two or three years after the purchase of the home), but until then, its inclusion can add significantly to monthly mortgage payment costs.

Since VA loans are guaranteed, this can be omitted, lowering monthly payments for the veteran purchasing the home. These loan benefits make VA loans more affordable than other loans.

Flexible Credit and Income Requirements

Finally, VA loans tend to be more accommodating to buyers who have stable income, but perhaps not an abundance of disposable income. Credit scores and debt-to-income ratios are major factors when applying for any form of lending. Most VA lenders generally have more flexible qualification standards than conventional lenders, making it easier for more applicants to qualify for the VA loan program.

Since both of those factors are directly tied to both an individual’s credit history and their cash flow, and both of those are tied to the person’s ability to secure and maintain a job with a livable wage so they can spend money on things besides bare necessities, it’s easy for a little bit of financial hardship to create a feedback loop.

You usually need a place to live and a means of transportation to find employment, and those cost money. But you need the employment to earn the money to pay for those things. Without some capital to jumpstart the process, it’s a chicken-and-egg scenario that quite often leaves people covering their basic expenses with room for little else in the budget.

Buying a home doesn’t necessarily change that dynamic in the short term, but it does allow the homeowner to build equity; instead of paying to a landlord, they’re paying off a loan on a property, which will belong to them when completed. It turns the liability into an asset, and VA loans make it easier for those with tight budgets to make it a reality. The VA loan program also limits loan related closing costs, making homeownership more accessible for qualified veterans. These loan benefits help more buyers achieve homeownership.

Beyond First-Time Homes: VA Loan Reuse, Refinancing, and Remodeling Options

We’ve talked a lot so far about mortgages, especially in the context of first-time homebuyers. But those aren’t the only way VA loans can be used, or the only kinds of loans available to veterans.

First and foremost, VA loans can be reused. That is to say, unlike a “first-time buyer” mortgage, you don’t lose access to this option simply by making your first home purchase. Even with some equity under your belt, you can still benefit from these unique advantages over civilian loans. VA home loan entitlement and full VA loan entitlement allow veterans to reuse their benefit for future home purchases, and loan assumptions are possible with an existing VA loan.

Second, VA loans can be used for things like refinancing and home renovations, similar to how traditional loans are often used. Veterans can refinance their existing VA loan to secure a new mortgage with better terms, and this process is available even after a short sale.

Surviving spouses may also be eligible for VA home loan benefits, and a service-connected disability can exempt a borrower from the funding fee. VA loan entitlement and loan limits affect the maximum loan and purchase price a veteran can secure. The VA loan volume has increased due to the popularity and flexibility of the VA home loan benefit. A purchase agreement for a VA loan should include specific clauses to protect the buyer, and building home equity is a key advantage of using a VA loan.

How to Apply for a VA Home Loan

The Department of Veterans Affairs oversees the application process, including the VA appraisal and review of the purchase agreement to ensure compliance with VA loan requirements. Buyers should also be aware of prepaid taxes and loan related closing costs, which can sometimes be negotiated with the seller as part of the transaction.

You can get a VA-backed loan through most private lenders. To navigate the VA loan program and the homebuying process, it’s recommended that buyers work with a real estate professional who understands the unique requirements of VA loans. But you’ll need to provide a Certificate of Eligibility (COE) to them first.

If you’re looking for VA home loans to help you, start here!

Allow us to guide you through the process of receiving benefits you deserve. Begin today by taking our free medical evidence screening, at Allveteran.com.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.