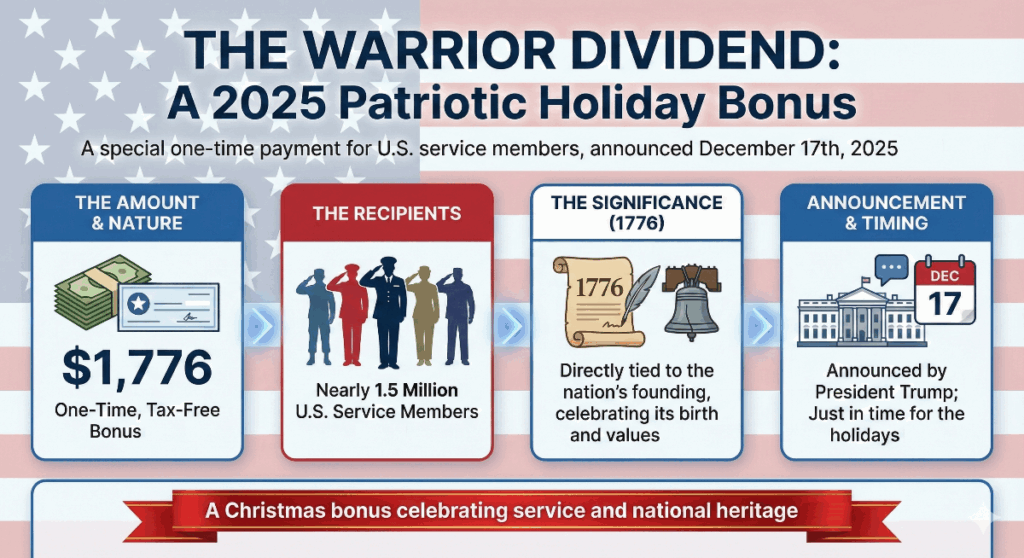

The warrior dividend is a term that’s making headlines right now, and for good reason. President Trump’s recent announcement introduced the warrior dividend as a $1,776 one-time, tax-free bonus for 1.45 million service members—just in time for the holidays. This special payment is directly tied to the nation’s founding in 1776, celebrating the birth of our great nation and the values it represents.

Why This Update?

President Trump recently announced a Christmas bonus this year to U.S. service members, during a White House speech on December 17th, 2025. The White House confirmed that the warrior dividend is a one-time pay providing a bonus to nearly 1.5 million service members.

Understanding the Military Warrior Dividend

What It Is and Why It Matters

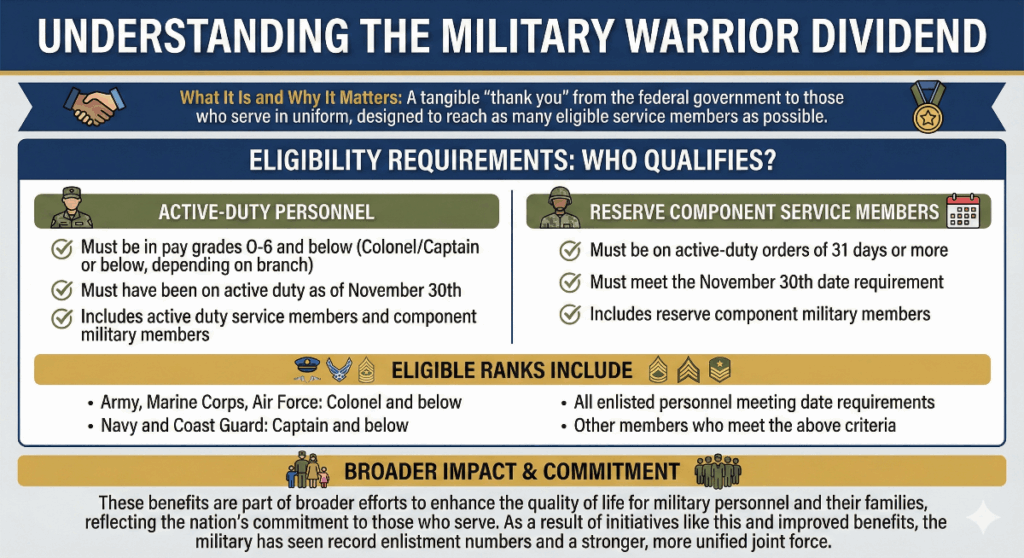

The warrior dividend represents more than just a bonus check—it’s a tangible “thank you” from the federal government to those who serve in uniform. The program was designed to reach as many eligible service members as possible.

Eligibility Requirements: Who Qualifies?

Active-Duty Personnel:

- Must be in pay grades O-6 and below (Colonel/Captain or below, depending on branch)

- Must have been on active duty as of November 30th

- Includes active duty service members and component military members

Reserve Component Service Members:

- Must be on active-duty orders of 31 days or more

- Must meet the November 30th date requirement

- Includes reserve component military members

Eligible Ranks Include:

- Army, Marine Corps, Air Force: Colonel and below

- Navy and Coast Guard: Captain and below

- All enlisted personnel meeting date requirements

- Other members who meet the above criteria

These benefits are part of broader efforts to enhance the quality of life for military personnel and their families, reflecting the nation’s commitment to those who serve. As a result of initiatives like the warrior dividend and improved benefits, the military has seen record enlistment numbers and a stronger, more unified joint force.

Making the Most of Your 1,776 Warrior Dividend and Housing Allowances

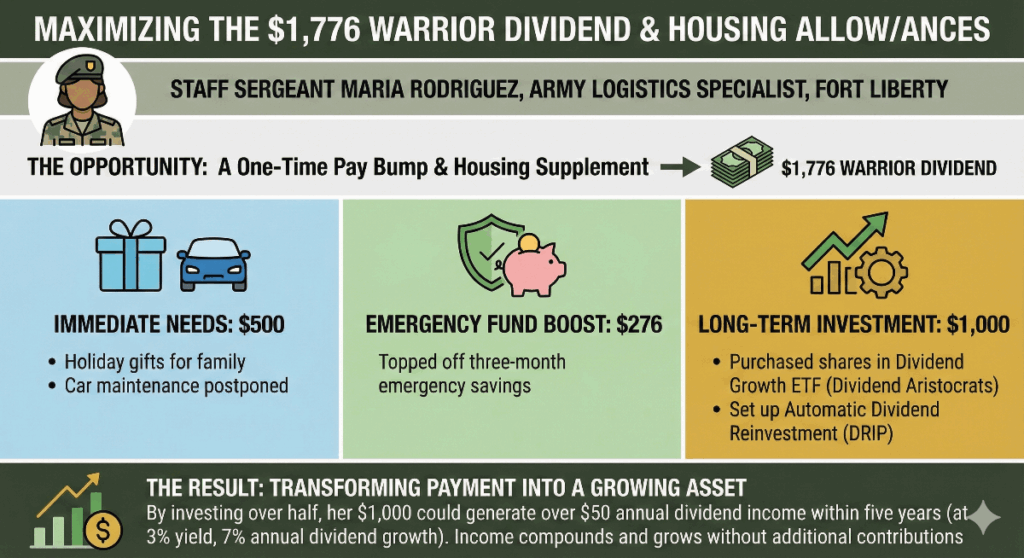

Let’s imagine Staff Sergeant Maria Rodriguez, a 28-year-old Army logistics specialist stationed at Fort Liberty as our example.

She’s been diligently saving for her daughter’s college fund and her own retirement. When the warrior dividend announcement came, Maria saw an opportunity. The payment she received was a one time pay bump and served as a housing supplement, designed to support service members like her.

Here’s how she strategically deployed her $1,776:

Immediate Needs ($500):

- Holiday gifts for family

- Car maintenance she’d been postponing

Emergency Fund Boost ($276):

- Topped off her three-month emergency savings

Long-Term Investment ($1,000):

- Purchased shares in a dividend growth ETF focusing on Dividend Aristocrats

- Set up automatic dividend reinvestment (DRIP)

By treating herself and her family while still investing over half the bonus, Maria transformed a one-time government payment into a growing asset. At a 3% yield with 7% annual dividend growth, her $1,000 investment could generate over $50 in annual dividend income within five years—income that compounds and grows without additional contributions.

Frequently Asked Questions (FAQ)

Q1: What exactly is the warrior dividend for military members?

A: The warrior dividend is a one-time, tax-free bonus of $1,776 for eligible U.S. service military members. Announced by President Trump, the warrior dividend serves to commemorate America’s founding year and to thank service members for their dedication as the nation approaches its 250th anniversary, with the payment timed to support military families during the holiday season.

Q2: When will active duty service members receive their warrior dividend payment?

A: The warrior dividend is a one-time payment scheduled to arrive before December 20th, ensuring service members receive it before Christmas.

Q3: Is the warrior dividend payment considered taxable income?

A: No. The payment is a one time basic allowance for housing supplement, considered a housing entitlement under IRS guidelines. As a tax free benefit, it is excluded from taxable income, so service members receive the full $1,776.

Q4: Do reservists qualify for the warrior dividend?

A: Yes, but with conditions. Reserve members, reserve component military, and reserve component military members must be on active-duty orders of 31 days or more as of November 30th to qualify for the payment.

The warrior dividend represents a meaningful recognition of military service, putting $1,776 in the pockets of nearly 1.5 million service members just in time for the holidays. Whether you’re using it to cover immediate expenses, boost your savings, or begin a journey, this tax-free bonus hopefully offers some relief.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.