Veterans and their spouses have access to several unique benefits as a result of their status. One form of benefits which many may not initially be aware of is access to Veterans Affairs or Veterans Administration home loans, or VA home loans.

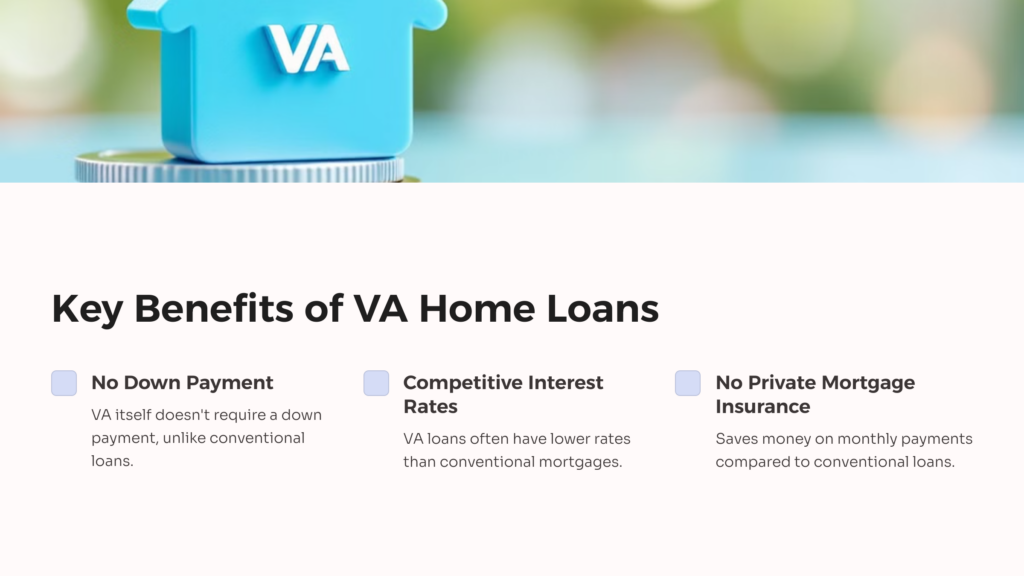

What are VA Home Loan Benefits?

In short, the financial benefits of a VA home loan program are that it allows Veterans to avoid many of the difficulties and expenses which are associated with a normal mortgage loan. Here are three specific benefits to consider:

First, the lack of a down payment. Most loans will require you to pay up to 20% of the home’s total value in advance. Fortunately, with VA home loans, VA itself does not require a downpayment (though some VA lenders you work with may still have their own down payment requirements).

Additionally, VA home loans will consistently have competitive interest rates, meaning that you will tend to get lower rates on your loan than the average conventional mortgage, since the VA is not as subject to the same market fluctuations as other lenders.

Finally, VA home loans will not require you to have private mortgage insurance. Insurance for a mortgage can be a requirement for a conventional loan, as insurance to the bank against your possible failure to make payments. This insurance normally comes into play for home buyers who don’t have the money for a substantial downpayment up front. Private mortgage insurance is often expensive and can add quite a bit of money to the monthly payments you’ll need to make on your home. With a VA home loan, no private mortgage insurance is required. A VA lender like Veterans United or Navy Federal Credit Union will provide this kind of VA loan benefit.

Eligibility Requirements for VA Home Loans

So who exactly is eligible for these loans as part of their VA benefits?

For service members and Veterans: in most cases, there is a requirement of a minimum of 90 days of continuous active service. For Veterans, this requirement may be slightly different depending on the dates of your service. It is also important that you have an honorable discharge of some type; other discharges may not qualify for VA home loan benefits without a change of discharge status.

For surviving spouses: if you are the surviving spouse of a veteran, or the spouse of a veteran who is MIA or a POW, you are also likely to be able to qualify for VA home loans.

Contact Veterans Affairs about requesting a Certificate of Eligibility for a VA home loan.

Financial Benefits and Cost Savings

The benefits mentioned above aren’t the only cost savings that you’ll get with a VA home loan. Normal home loans often include additional fees such as closing costs and fees for pre-paying your loan. VA home loans avoid prepayment penalties entirely and limit closing costs and fees. In addition, the lower interest rates will mean that you save a great deal of money over the life of the loan when compared to other methods of financing.

Flexibility and Options in VA Home Loans

VA home loans are fairly flexible, as long as they are helping you with a primary residence. What kind of loan type you need is determined by your situation and what you want to do with the loan. These are some of the loan types you can consider as a VA borrower:

- Purchase Loans: This is probably the first kind of loan people think of when looking at home loans–a purchase loan is there to help you buy a home, and it’s as simple as that. A VA purchase loan is helpful for veterans who are looking for a new home or for currently homeless veterans.

- Cash-Out Refinancing: This kind of loan works with the already-built equity of your home. By taking out a loan for the amount of equity you have, you can use that money to pay off other financial needs; for example, many people will use this kind of loan to make home improvements or to pay off other debts. A VA cash out refinance loan works in the same way.

- Interest Rate Reduction Refinance Loan: This loan, commonly called by the acronym IRRRL, is a way of refinancing a VA loan that you already have in order to get a lower interest rate on your loan and save money on it in the long run.

- Native American Direct Loans: The NADL Program is set up to help eligible Native American Veterans specifically with their homes on Federal Trust Land (or to reduce interest rates on a VA loan). A Native American Direct Loan can help Native American Veterans with purchase, construction, or improvement of these homes.

Understanding VA Loan Guaranty and Entitlement

Two terms that you might encounter are Guaranty and Entitlement. Both of these may make a difference on how much you are able to get for your VA home loan.

For guaranty, this is different from a guaranteed rate. To understand what the guaranty is, we will look at a definition from the VA: “A VA home loan guaranty means that a purchaser obtains a loan through a private lender, such as a bank, credit union or mortgage company. VA then works with the lender to guarantee the loan. If the home owner defaults on the loan, VA will pay the debt to the lender.”

In other words, the guaranty helps you get higher loan limits and better rates than you would on your own, because the VA will be backing up your loan amount (or at least a portion of it). With a higher loan limit, you have more purchasing power as a borrower.

Secondly, “entitlement.” How much you can get a loan for is dependent partly on your entitlement and whether it is full, partial, or used. Entitlement is based on your previous actions, if any, with VA loans.

Your entitlement is “full” if you have not yet used your home loan benefit, or if you have repaid a VA loan on a foreclosed or sold property. With full entitlement, you will have no limit from the VA on the amount that you can get a loan for (however, the lender working with your situation will still set an amount based on your credit score, assets, and income; it just will not be limited by the VA itself).

With partial entitlement, you may still be able to get another VA home loan; however, you’ll have a limit based not only on your credit and income, as normal, but also on how much of your original loan or loans are still outstanding versus paid back.

With no remaining entitlement, you will no longer be able to receive additional VA home loans until you have paid off some of your initial loans.

Additional Benefits and Resources for VA Borrowers

In addition, there are some other financial services that are provided by the VA:

- Adapted Housing Grants: these grants are another financial service provided by the VA. Instead of a home loan, these grants are for helping Veterans with permanent, service-connected disabilities build or modify homes that are adapted to help them with their disability.

- Foreclosure Avoidance Assistance: while not a loan or grant, this is a kind of financial counseling that the VA provides to help Veterans avoid foreclosure.

- VA home loan counseling: If you are a service member who is looking into housing options, the VA offers help with counseling and advice to get you started.

Conclusion:

If you want to learn more about how you or your loved ones might be able to benefit from VA home loans, you can get an individualized medical evidence evaluation for free today. Visit this site to check your VA loan eligibility.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.