The U.S. Department of Veterans Affairs (VA) offers a wide range of benefits to support those who have served our country, and one of the most valuable is the VA Home Loan Program. This benefit helps eligible veterans, active-duty service members, and certain surviving spouses buy a home with little or even no down payment.

What makes the VA home loan so powerful is its built-in guarantee from the VA, which reduces risk for lenders and makes homeownership more accessible for veterans. With no private mortgage insurance (PMI) requirement, competitive interest rates, and flexible refinancing options, this program continues to be one of the most significant financial tools available to those who served.

Below, we’ll break down how VA home loans work, who qualifies, how to apply, and where to find trusted resources for more information.

What Are VA Home Loans and How Do They Work?

VA home loans are mortgage loans backed by the U.S. Department of Veterans Affairs, designed specifically for eligible military personnel, veterans, and certain surviving spouses. The VA doesn’t directly lend money; instead, it guarantees a portion of the loan—this is known as the VA home loan guaranty benefit, and is the foundation of the VA-backed home loan program. These loans are issued by private lenders, such as banks and mortgage companies, which reduces risk for private lenders and enables them to offer more favorable terms to qualified borrowers.

This government backing is what makes VA loans so powerful – it offers benefits that simply aren’t available with conventional mortgages, including zero down payments and no private mortgage insurance requirements.

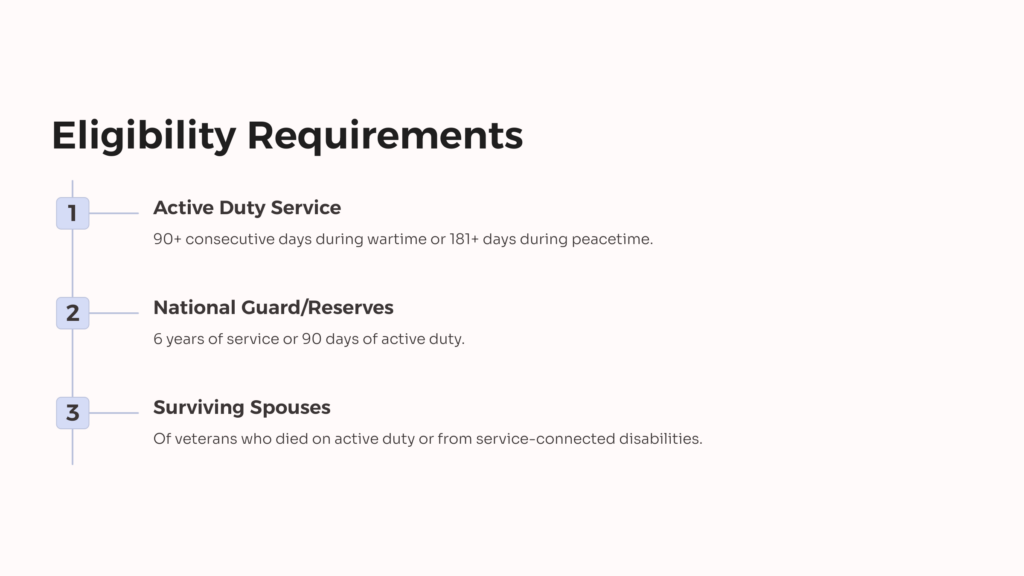

VA Loan Eligibility Requirements: Who Qualifies?

Service Requirements

To qualify for a VA loan based on your service history and duty status, you must meet specific service criteria established by the VA:

Active Duty Service Members:

- Wartime service: 90 consecutive days on active duty

- Peacetime service: 181 consecutive days on active duty

National Guard and Reserve Members:

- Six years of service, OR

- 90 days under Title 32 orders (with at least 30 consecutive days)

Discharge Status: You must be discharged under conditions other than dishonorable. Service members discharged due to a service-connected disability may qualify regardless of their length of service. Your service history and duty status are key factors in obtaining a Certificate of Eligibility (COE), which verifies your qualification for a VA direct or VA-backed loan.

Surviving Spouses Eligibility

Eligible surviving spouses may also qualify if:

- The veteran died while on active duty or from a service-connected disability

- The spouse remarried on or after December 16, 2003, and after attaining age 57

- The spouse of a living service member who is missing in action (MIA) or a prisoner of war (POW) for more than 90 days

A surviving spouse must provide documentation to obtain a Certificate of Eligibility (COE) in order to access VA loan benefits.

Certificate of Eligibility (COE)

The Certificate of Eligibility is a crucial document required for both VA-backed loans and VA direct loans. It verifies your service history and duty status, confirming you meet the VA’s eligibility guidelines. Many VA-approved lenders can help you obtain this document through the VA’s eBenefits portal, often within minutes.

Key Benefits of VA Home Loans

Understanding VA home loans means recognizing their extraordinary advantages over conventional and FHA loans. These unique advantages are made possible by the home loan guaranty benefit, which means the VA guarantees a portion of the loan to help Veterans and their families secure better terms. VA home loans also offer a range of loan options to suit different needs.

1. Zero Down Payment Required

Perhaps the most significant benefit is that qualified borrowers can purchase a home with no down payment, regardless of the loan amount. This eliminates one of the biggest barriers to homeownership – saving for a substantial down payment.

2. No Private Mortgage Insurance (PMI)

Unlike conventional loans that require PMI when you put down less than 20%, VA loans never require private mortgage insurance. This can save borrowers hundreds of dollars monthly and thousands annually.

3. Competitive Interest Rates

VA mortgage rates are consistently among the lowest available in the market. The VA’s guarantee reduces lender risk, allowing them to offer more favorable interest rates that translate to lower monthly payments and significant long-term savings, such as a reduced monthly payment compared to conventional loans due to no required private mortgage insurance and competitive rates.

4. Flexible Credit Guidelines

VA loans are known for more forgiving credit requirements. While individual lenders set minimum credit scores (often around 620), these are generally lower than conventional loan requirements, and the VA considers the complete financial picture rather than just credit scores.

5. Limited Closing Costs and Seller Concessions

The VA limits what lenders can charge for originating and processing loans. Additionally, sellers can pay all of a buyer’s VA loan closing costs and up to 4% of the loan amount in concessions, significantly reducing out-of-pocket expenses.

6. Assumable Loans

VA loans are assumable, meaning qualified buyers can take over your existing mortgage. This feature is particularly valuable in rising interest rate environments, as new buyers can inherit potentially lower rates.

7. Lifetime Benefit and Reusability

The VA loan benefit is a lifetime entitlement that can be used multiple times. You can regain your full entitlement after selling a home and repaying the original VA loan, and it’s even possible to use remaining entitlement for a second home under certain conditions.

8. No Loan Limits for Full Entitlement

As of 2020, eligible veterans with full VA loan entitlement face no limits on borrowing amounts without a down payment, which applies to the total loan amount, subject to lender credit and income requirements. For 2025, standard VA loan limits are $806,500 in most areas and up to $1,209,750 in high-cost regions.

Types of VA Home Loans Available

Understanding VA home loans includes knowing the various types available to meet different needs: VA offers both VA-backed home loans and VA direct loans, as well as other housing related programs to support veterans and their families.

Purchase Loan

VA purchase loans are a type of VA-backed loan that allow you to buy a new or existing home with zero down payment. Can be used for single-family homes, condominiums in VA-approved projects, multi-unit properties (up to four units with owner occupancy), manufactured homes, and new construction.

Interest Rate Reduction Refinance Loan (IRRRL)

The VA IRRRL (Interest Rate Reduction Refinance Loan) or VA Streamline, allows veterans with existing VA loans to refinance into lower interest rates or switch from adjustable-rate to fixed-rate mortgages. These VA IRRRL refinance loans are often simpler and lower-cost than traditional refinances.

Cash-Out Refinance

This refinancing option allows homeowners to refinance for a higher amount and take cash from their home’s equity, typically up to 90% of the home’s value. The cash can be used for home improvements, debt consolidation, or other financial needs.

Renovation/Rehab Loans

These loans allow veterans to purchase or refinance a home and finance approved repairs into a single VA loan, ideal for customizing properties or bringing older homes up to VA standards.

Energy Efficient Mortgage (EEM)

Veterans can borrow additional money (up to $6,000) for energy-efficient improvements like storm windows, heat pumps, and solar systems.

Native American Direct Loan (NADL)

The Native American Direct Loan (NADL) is a VA direct loan program that assists eligible Native American veterans in purchasing, building, or improving homes on federal trust land.

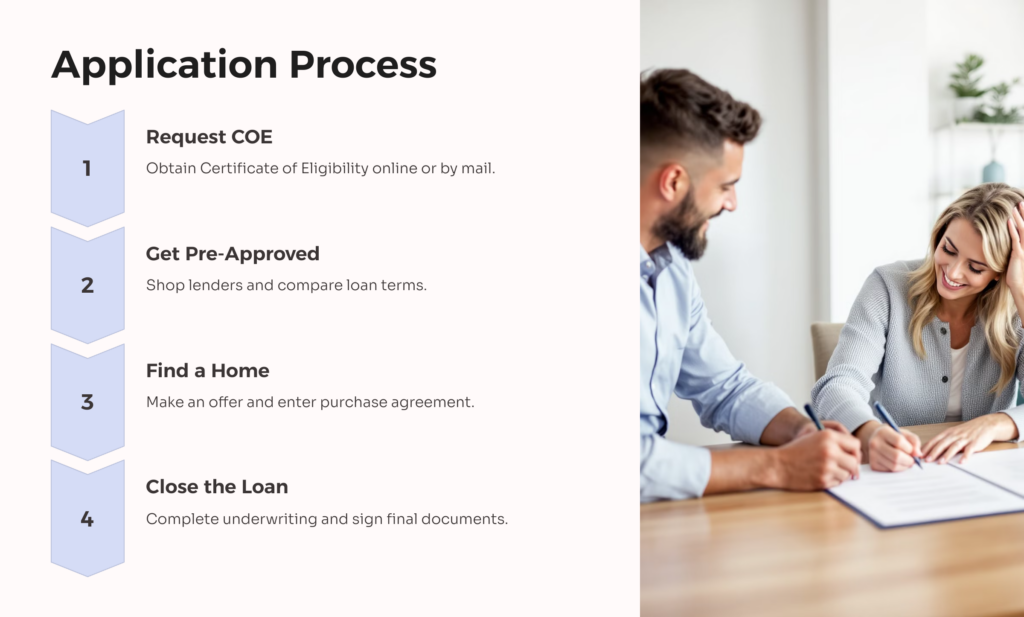

The VA Loan Application Process

Understanding VA home loans includes navigating the application process. You are not required to receive financing from any specific lender; you can choose from a variety of VA lenders, each offering different options and expertise to help you secure the best VA loan for your needs.

Step 1: Obtain Your Certificate of Eligibility (COE)

Verify your eligibility through the VA’s eBenefits portal, by mail, or with help from your chosen lender.

Step 2: Choose a VA-Approved Lender

Shop around and compare offers from multiple VA-approved lenders, including banks, credit unions, and mortgage companies, to find the most competitive rates and terms.

Step 3: Get Pre-Approved

Submit financial documents to determine your borrowing capacity and strengthen your position when making offers.

Step 4: Find a Home and Sign a Purchase Agreement

Work with a knowledgeable real estate agent and include a “VA Escape Clause” in your purchase agreement to protect yourself if the appraisal comes in low.

Step 5: VA Appraisal and Home Inspection

The lender orders a VA-approved appraiser to assess value and ensure the property meets Minimum Property Requirements (MPRs). Consider getting a separate home inspection for a thorough property assessment.

Step 6: Underwriting and Closing

Your loan moves through underwriting for final approval, followed by closing where you sign paperwork and take ownership.

Important Considerations and Potential Drawbacks

While VA loans offer tremendous benefits, understanding VA home loans means being aware of certain limitations. In addition to these benefits and considerations, Veterans Affairs also offers housing related programs to assist veterans, service members, and their spouses with homeownership and housing needs, including home loan guaranties and support services.

VA Funding Fee

Most borrowers pay a one-time funding fee ranging from 1.25% to 3.3% depending on loan type and usage. Veterans with VA disability income, Purple Heart recipients, and certain surviving spouses are exempt.

Property Restrictions

VA loans can only be used for primary residences – not investment properties or vacation homes. Condominiums must be in VA-approved developments.

Lender-Specific Requirements

Individual lenders set their own credit score minimums (typically 620+) and debt-to-income ratio requirements, though these are generally more flexible than conventional loans.

Potential Seller Bias

Some sellers may have misconceptions about VA loans, though recent changes allowing veterans to pay certain buyer-broker fees are helping level the playing field.

Making the Most of Your VA Loan Benefit

Understanding VA home loans is just the beginning – successfully leveraging this benefit requires:

- Working with experienced VA-approved lenders

- Getting pre-approved to understand your budget

- Using knowledgeable real estate agents familiar with VA transactions

- Taking advantage of seller concessions when possible

- Considering the lifetime nature of the benefit for future moves

Building a Future with the VA Home Loan Advantage

The VA Home Loan Program remains one of the most powerful benefits available to veterans and their families, offering affordable paths to homeownership, financial flexibility, and long-term stability. By removing traditional barriers like large down payments, strict credit requirements, and private mortgage insurance, VA loans make it possible for more service members to build equity and security for the future. Whether you’re buying your first home, refinancing for a better rate, or restoring your VA entitlement, the program is designed to honor your service by supporting your financial goals.

If you’re ready to confirm your eligibility or want help navigating your VA home loan options, visit AllVeteran.com and see how we can help. Our expert team can review your service history, help you gather documentation, and ensure you’re getting every VA benefit you’ve earned through your service.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.