For qualified veterans, the VA home loan program, or the VA mortgage program, makes buying a home more affordable, and convenient. Guaranteed by the US Department of Veterans Affairs, VA loans often don’t require downpayments, and offer access to excellent rates, even for those with a problematic credit score.

However, there are various types of VA loans available, designed for specific groups and use cases, from the VA rehab and renovation loan to the VA Energy Efficient Mortgage. The NADL VA loan is the solution specifically tailored to the needs of Native American veterans.

What is the NADL Program? NADL VA Loans

The NADL VA loan program is one of the many forms of veteran assistance offered by the US government to qualified veterans. It’s provided alongside VA solutions for direct home loans, cash out refinance loans, purchase loans, and more.

According to the Department of Defense, American Indians and Alaska Natives make up a significant portion of the US armed forces. To ensure these groups get the right support, the VA team consults with American Indian and Alaska Native tribal governments, to deliver specific service packages, such as the NADL loans for native veterans.

Like standard VA loans, the NADL VA loans offer access to low-interest rates for the life of your loan, guarantees from the VA, and you can even use the program multiple times if you decide to sell your property in the future.

Eligibility Requirements for NADL VA Loans

The Native American Veteran loan program makes home loans accessible (and more affordable), to eligible Native American veterans, who want to purchase, improve, or construct a home on Federal Trust land. To apply for the loan, the property must be your primary residence.

Additionally, you must be a verified veteran (including reserve or national guard members), active duty service member, current reserve or guard member, or the spouse of a native American veteran. To be eligible for an NADL VA purchase loan, you’ll also need:

- Your tribal government to have an agreement (memorandum of understanding) detailing how the program will work on trust lands.

- A valid VA home loan certificate of eligibility (COE).

- An acceptable credit score.

- Proof you make enough money to make mortgage payments.

- Proof you’ll live in the home you’re using your NADL loan for.

The Benefits of NADL VA Loans for Native Americans

For a retired or active service member, veteran loans can offer several benefits. The NADL VA loans extend these benefits to minority veterans who pass eligibility requirements. With an NADL VA loan, you can expect benefits like:

- No down payment on your mortgage (in most cases)

- No requirements for private mortgage insurance (PMI)

- Limited closing costs related to accessing your home.

- Low-interest 30-year fixed mortgages. Current VA interest rates start at approximately 2.5% but can vary depending on various factors.

- The ability to access a cash-out refinance solution for a lower interest rate.

- Options to borrow up to the Fannie Mae/Freddie Mac conforming loan limit

Additionally, the NADL veterans loans is a reusable benefit, so you can access more than one loan for buying, building, and improving residences in the future.

How NADL VA Loans Differ from Traditional VA Loans

The Department of Veterans Affairs offers a range of solutions to eligible veterans, from disabled veteran insurance, to VA home loans and housing grants, Veterans Affairs life insurance, and more. Each VA solution comes with its own unique nuances to consider.

Both traditional VA loans and NADL VA loans are guaranteed by the Department of Veterans Affairs, and are typically issued by a private lender. The added protection from the government means an eligible veteran can access better interest rates, and more lenience from lenders on credit scores.

The main difference between traditional VA loans and NADL loans is they’re specially designed for native Americans and minority veterans, as well as their spouses. They can also only be used to buy, build, or renovate a home located on federal trust land.

Offers are created in conjunction with the American Indian and Alaska Native tribal governments, to ensure native American families can access all the benefits they’re entitled to receive.

Understanding the Application Process for NADL VA Loans

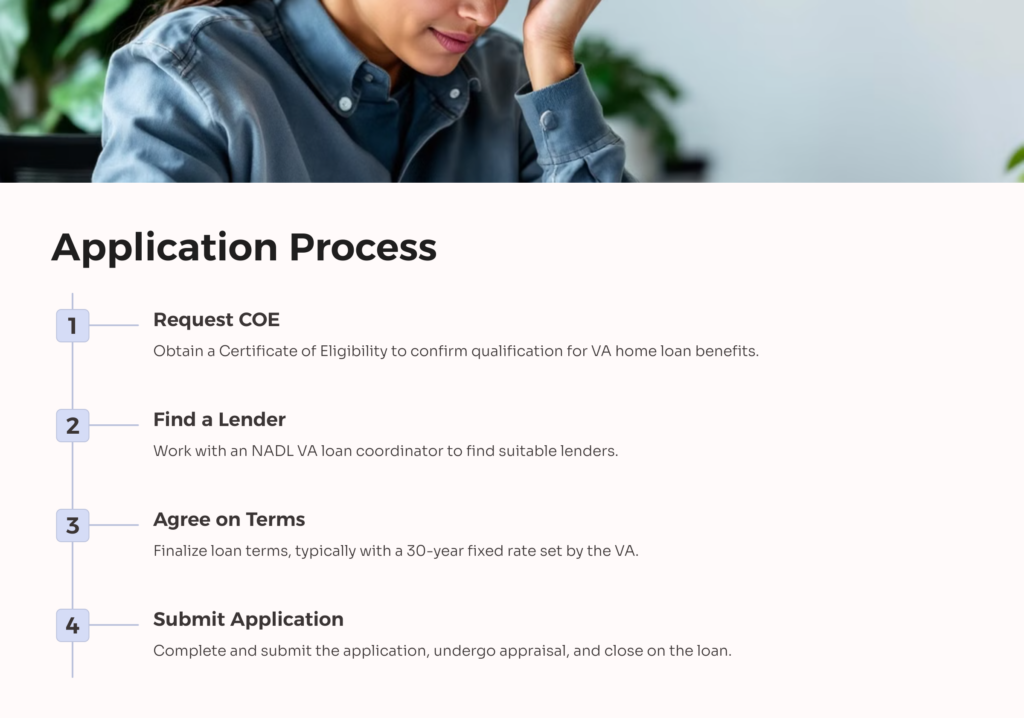

The first step in accessing an NADL VA loan is checking your eligibility. You can find a complete list of eligibility requirements listed on the VA website. Keep in mind, you may also need to pay the VA funding fee to access the program. Here’s the step-by-step process you can expect.

Step 1: Request a VA Home Loan COE

First, you’ll need a Certificate of Eligibility to confirm you qualify for a VA home loan benefit. You’ll be required to fill out the same VA form all veterans use to access VA loans. You can apply online using the VA.gov website, or choose to work with an accredited representative or agent. There’s also the option to visit a VA regional office for support.

To receive a COE, you’ll need to have proof that you’ve served for at least 90 continuous days, and that you meet the minimum active duty service requirements. Remember, for an NADL loan, you’ll need there to be an MOU between the tribe and the VA, and you or your spouse will need to be recognized as a Native American subject to the jurisdiction of the tribe.

Step 2: Find the Right Lender

Next, you’ll meet with an NADL VA loan coordinator, to begin the process of searching for a lender for your home. Lenders can vary in the support they offer. Some offer access to a wide range of loan types, and others will consider borrowers with lower credit.

Your coordinator will work with you to ensure you’re pre-approved by multiple VA mortgage lenders, so you can compare their mortgage rates and qualification requirements.

Step 3: Agree on Loan Terms

Typically, the interest rate for an NADL VA loan is set by the VA, and the length of the loan will last 30 years. However, interest rates and terms can vary. Interest Rate Reduction Refinancing Loans may be available if your previous loan was an NADL loan, and there’s a 1% difference in rates.

During the loan process, your tribe may be asked to provide the VA of copies of the lease to be used, and any tribal foreclosure ordinances. During this time, you may also work with a real estate agent to help you find a home that meets the minimum property requirements for your needs.

Step 4: Submitting the Application

Once you’ve chosen your loan and the MOU is in place, you can complete the application and submit it to the VA. Your mortgage lender will examine your financial situation and request a VA appraisal to ensure the home meets all of the correct requirements.

If your application and appraisal are approved, the final step will be to close on the loan. The VA will schedule a closing data at your convenience. If you’re requesting a construction loan, the VA will reimburse the builder through escrow accounts. Finances are allocated upon evidence of approved progress.

Resources and Support for Native American Veterans

Various resources are available both in-person and online to help you with the NADL VA loan process. Excellent options include:

- The Regional Loan center information site for VA loans

- The VA’s list of accredited attorneys, claim agents, and VSO representatives

- VA facility locator page for finding regional offices

- The VA page for overviews of all benefits available to veterans

- Native American Direct Loan Program website

- The Office of Tribal Government Relations site

- Resources for VA Recognition as a Tribal Organization

Accessing your NADL VA Loan

The NADL VA program is an excellent way for Native Americans and minority veterans to access home loan solutions. With this service, you can access better interest rates on your loan, eliminate the need for down payments, and even access good terms when you have a poor credit score.

To find out more about applying for your NADL VA loan, or any other form of VA support, reach out to the team at All Veteran. We offer extensive support for VA form management, finding the right loan for your needs, and more. You can get started with application today, with our simple VA loan evaluation system here.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.