For many who have worn the uniform, the battle doesn’t end when service does. Veterans and military families often face unique money struggles that civilians rarely encounter. From the steep costs of medical care and unexpected VA benefit overpayments to the income gaps that come with transitioning back into civilian life, debt can quickly become overwhelming. What should be a time of stability and honor too often turns into a fight for financial freedom.

Here is what you need to know about the available resources and strategies to break free from debt and reclaim control over your future.

Understanding the Unique Financial Challenges Veterans Face

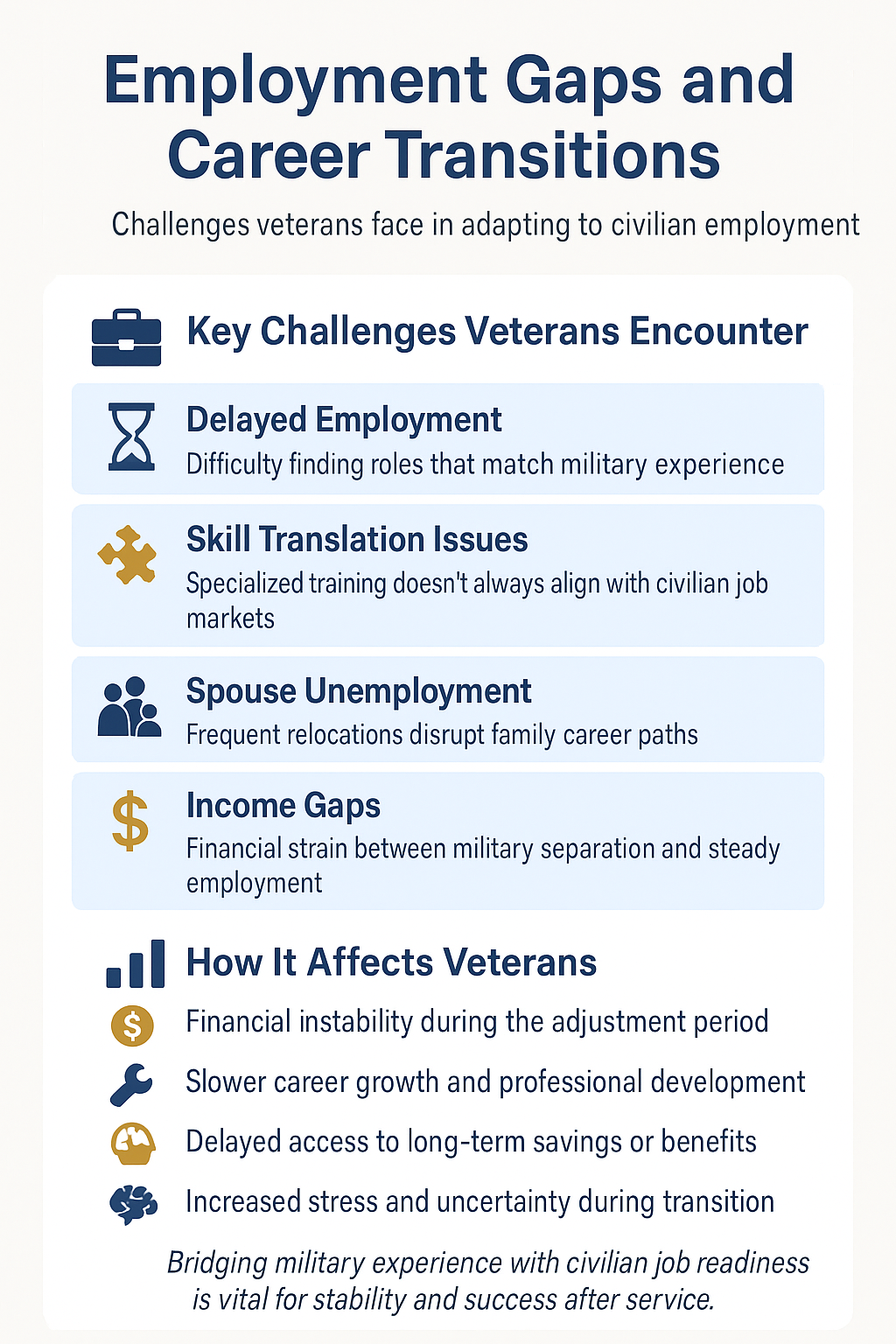

Employment Gaps and Career Transitions

The transition from structured military life to civilian life and the workforce presents significant hurdles.

There may be delays in finding employment where military skills translate effectively. In some cases, spouses may experience unemployment due to frequent military relocations. Not to mention, there are income gaps between military separation and stable civilian employment.

Overall, it can be difficult to adapt your specialized military training to civilian job markets. So, the expenses start to pile up.

Relocation and Moving Expenses

Post-service life often requires costly relocations:

- Moving fees and transportation costs

- Housing deposits and utility setup fees

- Temporary lodging expenses during transitions

- Equipment and household goods replacement costs

Frequent relocations can disrupt employment opportunities for military spouses and create additional challenges for every member of the family, making it important to consider the broader impact on military families.

Medical Debt and Disability-Related Expenses

While VA healthcare provides coverage, veterans may still face:

- Out-of-pocket costs for specialized treatments not fully covered

- Long-term rehabilitation expenses

- Emergency medical bills

- Living modifications for service-connected disabilities

- Issues with VA disability compensation, which can also contribute to medical debt for veterans

VA Benefit Overpayments

VA benefit overpayments are a common source of veteran debt.

These overpayments are often caused by:

- Administrative errors in benefit calculations

- Delayed updates when income or family status changes

- Misunderstandings of eligibility requirements

- Processing delays affecting benefit determinations

VA Debt Management: Direct Debt Relief Options

The Department of Veterans Affairs offers several veteran debt relief programs specifically designed to help manage VA-related debts.

Understanding VA Debt Types

VA debt encompasses various obligations that can affect both veterans and active duty military personnel who receive VA benefits, including:

- Disability compensation overpayments

- Pension benefit overpayments

- GI Bill education benefit overpayments

- Healthcare copayment balances

- VA-backed loan defaults

VA Repayment Plans

Veterans can request structured repayment plans to manage VA debt over time:

- Short-term plans: For debts repayable within five years, often without requiring extensive financial documentation

- Extended plans: For larger debts or severe hardship cases, requiring completion of VA Form 5655 (Financial Status Report)

- Flexible terms: Payment schedules adjusted based on individual financial capacity

Some repayment plans may require veterans to make minimum payments each month to avoid default.

Debt Waivers and Forgiveness

Veterans facing genuine financial hardship can request debt waivers. Hardship waivers can provide complete or partial debt forgiveness for veterans facing financial hardship and unable to repay due to circumstances beyond their control.

You will need to submit a VA Form 5655. This is financial documentation demonstrating the inability to pay. Personal statements with explanations of hardship circumstances are also helpful.

Most importantly, your timely submission makes a difference. Your request should be submitted within one year of receiving the first debt notice.

Compromise Offers

There are options for veterans who cannot repay full VA debt amounts but can offer partial payment. You can take a lump-sum settlement offer for less than the total debt. There is typically a 30-day payment requirement once offers are accepted. Once payment has been made, your full debt will be satisfied.

Disputing VA Debt

Veterans believing their VA debt resulted from errors can file a dispute within 180 days after receiving their debt notice. You will need to provide supporting documentation for error claims and request recalculation of benefit determinations.

It’s important to submit disputes within 30 days to avoid collection actions.

Federal Protections for Military Members and Veterans

Several federal laws provide crucial debt relief for veterans, active-duty service members, and military personnel through protective legislation.

Servicemembers Civil Relief Act (SCRA)

The SCRA offers significant financial protections for active-duty personnel, including:

Interest Rate Reductions:

- 6% annual interest cap on pre-service loans

- Applies to mortgages, auto loans, credit cards, and student loans

- Automatic application upon notification to creditors

Housing Protections:

- Foreclosure prevention without court orders

- Eviction protection for rental properties

- Lease termination rights for deployment or relocation

Credit Protection:

- SCRA usage doesn’t negatively impact credit reports

- Payment delays don’t constitute defaults when properly documented

- Extended protections for ongoing legal proceedings

- Maintaining good standing under the SCRA can help protect a service member’s security clearance by demonstrating financial responsibility.

Military Lending Act (MLA)

The MLA protects active-duty service members through:

- 36% Military Annual Percentage Rate (MAPR) cap on consumer loans

- Coverage of payday loans, auto title loans, vehicle title loans, and installment loans

- Protection against predatory lending practices

- Application to covered dependents

Total and Permanent Disability Discharge

Veterans with service-connected total and permanent disabilities may qualify for:

- Complete federal student loan discharge

- Automatic identification through VA-Department of Education data matching

- Direct application processes

- Significant debt relief for qualifying veterans

Organizations like DAV (Disabled American Veterans) can assist veterans with the disability discharge process.

Debt Consolidation and Management Strategies

Veterans can utilize various consolidation strategies to simplify and reduce their debt burdens. A debt consolidation loan can help veterans combine debt into one monthly payment, often at a lower interest rate. These consolidate debt loans can be used to pay off unsecured debts such as credit cards and medical bills, making it easier to manage multiple obligations.

Among the available options, veterans may consider a personal loan, which is typically unsecured and can be used for debt consolidation or other financial needs.

VA Cash-Out Refinance Loans

This unique debt relief option allows homeowners to:

- Access home equity to pay off high-interest debts

- Refinance existing mortgages with cash-out options

- Replace conventional mortgages with VA-backed loans

- Benefit from competitive VA loan interest rates

Important Considerations:

- Home serves as collateral

- Risk of foreclosure if payments are missed

- Potential for long-term savings through lower interest rates

Military-Focused Personal Loans

Several financial institutions offer veteran-specific lending:

- USAA Bank: Competitive rates for military members

- PenFed Credit Union: Veteran-friendly loan terms

- Navy Federal Credit Union: Specialized military lending programs

- Lower interest rates compared to general market loans

Veterans with good credit are more likely to qualify for the lowest interest rates on personal loans from these institutions.

Debt Management Plans (DMPs)

Nonprofit credit counseling agencies offer a debt management plan as a structured debt repayment option through:

- Negotiated interest rate reductions with creditors

- Consolidated monthly payments

- 3-5 year debt retirement timelines

- Credit score improvement potential

Grant Programs and Financial Assistance

Numerous organizations provide non-repayable financial assistance specifically for veterans. These programs offer financial help, veteran debt assistance, and military debt relief to service members, veterans, and military families who are facing financial hardships.

Major Grant Programs

Veterans of Foreign Wars (VFW) Unmet Needs Program:

- Grants up to $1,500 for unexpected financial difficulties

- Direct payments to creditors

- Available for veterans and their families, including any eligible family member

USA Cares Veteran and Family Support Program:

- Financial assistance for post-9/11 veterans and their families

- Emergency aid for housing, utilities, and basic needs

- Career training and skill development support for veterans and family members

Operation First Response:

- Comprehensive financial assistance for disabled veterans

- Coverage for rent, utilities, vehicle payments, and groceries

- Support from injury through civilian transition

American Legion Cash Grants:

- Emergency assistance for shelter, food, and utilities

- Health expense coverage

- Family support during crisis periods

Specialized Assistance Programs

American Red Cross Military Financial Assistance:

- 24/7 emergency financial support

- Travel assistance for family emergencies

- Burial and funeral expense support

Disabled American Veterans (DAV):

- Comprehensive support for disabled veterans

- Benefit claim assistance

- Transportation and employment programs

Housing-Specific Grants:

- Homes for Our Troops mortgage-free adapted homes

- Building Homes for Heroes construction programs

- Habitat for Humanity Veterans Build partnerships

- Homeowners Assistance Program (HAP) offers financial aid to qualified candidates, such as active service members, veterans, and surviving spouses, facing housing-related financial hardship.

Housing Assistance and Foreclosure Prevention

Housing stability is crucial for veteran financial recovery, with multiple programs addressing these needs, including home loans such as VA-backed options that help veterans achieve housing stability.

VA Home Loan Benefits

The VA Home Loan Program provides:

- No down payment requirements (in most cases)

- Competitive interest rates

- No private mortgage insurance (PMI) requirements

- Interest Rate Reduction Refinance Loans (IRRRL)

Foreclosure Prevention Programs

Veterans Affairs Servicing Purchase (VASP):

- VA direct intervention in foreclosure situations

- Loan purchase and restructuring options

- Sustainable repayment plan development

- Members of the National Guard may also qualify for these foreclosure prevention protections under certain circumstances.

HUD-VASH Program:

- Long-term rental assistance through Housing Choice Vouchers

- Intensive case management from VA social workers

- Support for chronically homeless veterans

Emergency Housing Assistance

Supportive Services for Veteran Families (SSVF):

- Rapid rehousing assistance

- Homelessness prevention services

- Temporary financial assistance for rent and utilities

Employment and Education Support

Addressing underlying causes of debt through career development and education provides long-term solutions to debt. These programs aim to empower veterans and support their long term financial independence by offering resources and opportunities that help them build stable, successful civilian lives.

Education Benefits

GI Bill Programs:

- Post-9/11 GI Bill comprehensive education coverage

- Housing allowances and stipends for educational expenses

- Benefit transferability to spouses and children

Yellow Ribbon Program:

- Additional tuition coverage beyond GI Bill limits

- Partnerships with private and out-of-state institutions

Career Development Programs

Veteran Readiness and Employment (VR&E):

- Career counseling for disabled veterans

- Job training and placement assistance

- Educational funding for career preparation

SkillBridge Program:

- Civilian work experience during final 180 days of service

- Apprenticeships and job training opportunities

- Smooth transition from military to civilian employment

Financial Counseling and Education Resources

Professional financial guidance is essential for sustainable debt relief and long-term financial stability. Understanding your credit history and regularly reviewing your credit report are important steps in financial counseling.

Nonprofit Credit Counseling

Accredited organizations:

- National Foundation for Credit Counseling (NFCC) members

- Financial Counseling Association of America (FCAA) certified counselors

- InCharge Debt Solutions

- Military-specific counseling services

Government Resources

MilitaryOneSource:

- Free financial counseling for military families

- Tax preparation assistance

- Transition planning workshops

- Confidential support services

VA Financial Counseling:

- Specialized VA debt management guidance

- Benefit optimization advice

- Financial planning for veterans with disabilities

Creating a Sustainable Financial Recovery Plan

Successful debt relief requires a comprehensive approach combining immediate progress with long-term financial planning. The goal of a financial recovery plan is reducing debt and ultimately becoming debt free.

Immediate Steps

There are some immediate steps you can take to create a more sustainable plan for the future.

- Assess total debt obligations including VA debt, credit cards, loans, and medical bills

- Contact the VA Debt Management Center for VA-related debts

- Explore federal protections if currently on active duty

- Request payment plans or waivers for unmanageable debts

- Seek nonprofit credit counseling for comprehensive debt analysis

Long-term Strategies

In the long term, you can work to develop realistic budgets incorporating all income sources and expenses. It’s also key to build emergency funds to prevent future debt accumulation. To further your financial standing, you can pursue education and training to increase earning potential.

Be sure to maintain regular communication with creditors and service providers, and always monitor credit reports and work toward credit improvement.

Building Financial Resilience

If you want to be financially resilient, take the time to establish multiple income streams when possible. You can also take advantage of veteran-specific benefits and programs. Build strong support networks through veteran service organizations. Also, plan for the future by planning for your goals and retirement.

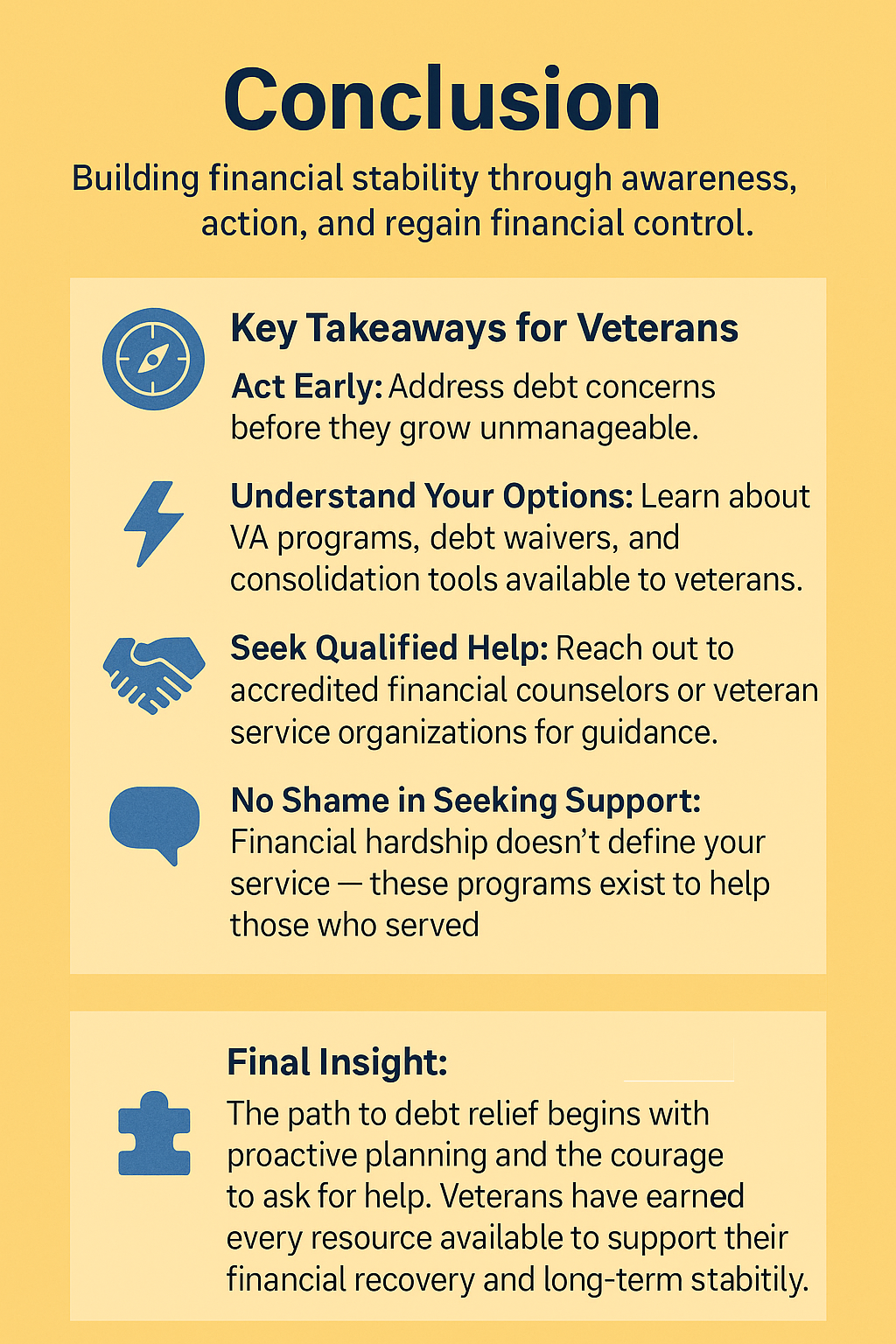

Understand Your Options and Take Action

The key to successful debt relief lies in early action, thorough understanding of available options, and willingness to seek help from qualified professionals and organizations. Veterans should never feel ashamed about financial difficulties – the resources exist precisely because society recognizes the unique challenges military service members face.

At Allveteran.com, we seek to help veterans connect with resources that may make all the difference. To find out your disability rating, take our free medical evidence screening today!

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.