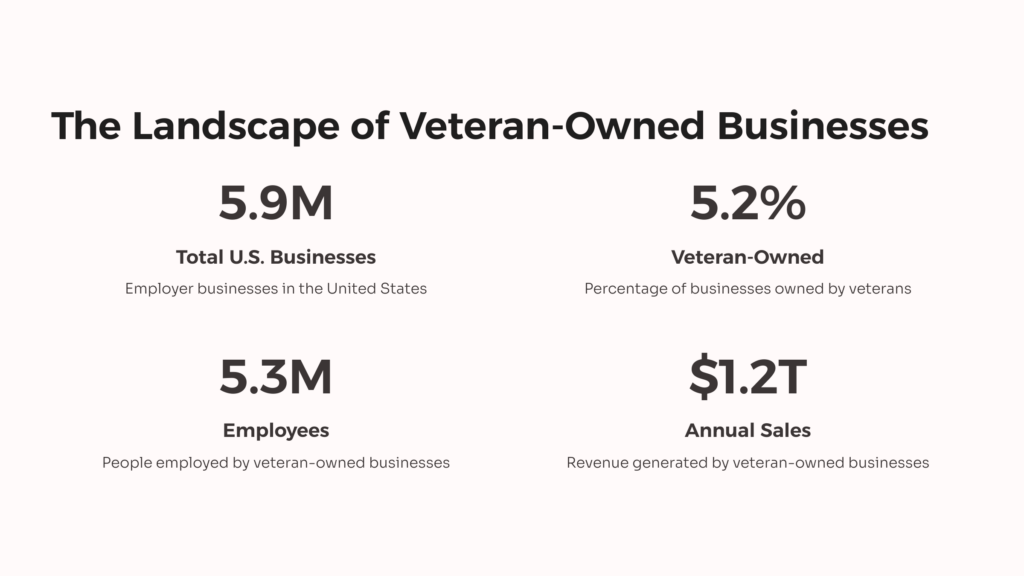

The 2022 Annual Business Survey reports more than 5.9 million employer businesses in the United States, of which 5.2% are veteran-owned firms. Most small business owners use business loans to start a company or scale an existing one.

By securing a veteran business loan, you can unlock the potential for your business to flourish. This financial support can enable you to open new locations, expand your workforce, or even secure additional working capital to ensure the smooth operation of your company.

You can pursue many veteran business loans, including a Veterans Advantage small business loan, financing from the Small Business Administration (SBA), traditional business financing, or business grants. To decide which veteran business loan is the best option for you, you must consider the strengths and purposes of each financing option.

The Importance and Benefits of Veteran Business Loans

The SBA offers VA business loans to help veterans fund their business ventures. The SBA connects qualified veterans with lenders when they would otherwise not know where to start seeking funding.

Versatile by design, veteran-owned business loans can help you do many things, including:

- Pay Operating Expenses: After your business is up and running, you can use your veteran entrepreneur loan to cover recurring monthly expenses, like office supplies, accounting software subscriptions, taxes, and utilities.

- Cover startup expenses: Although many military veterans bankroll their business’s startup expenses, not everyone has adequate personal financial reserves. You can use funds from a veteran business loan to cover all the costs you’ll incur while setting up your business, including rent, business incorporation, supplies, utilities, salaries, marketing, and inventory.

- Hire employees: You can’t grow your company alone. With a veteran business loan, you can hire more employees and pay them fairly to keep them motivated and engaged.

- Invest in marketing campaigns: Customers won’t visit your business if they don’t know it exists. To that end, you can use your veteran financing to market your business and generate more sales. To market your company, you must create and promote relevant content on your website, send coupons and offers in the mail, and consider creating social media ads.

- Foster economic growth and job creation: Veteran-owned businesses are vital in job creation and overall economic growth. The SBA reports that veteran-owned companies employ approximately 5.3 million employees and generate over $1.2 trillion in annual sales. These businesses create jobs and boost local economies, improving prosperity for many.

Unlike other types of loans that must be invested in specific ways, veteran-owned franchise loans are more flexible. Thus, veteran business owners can leverage the funds they receive in whatever way best suits their businesses.

How to Qualify for Veteran Business Loans and Grant Opportunities

The qualifications veterans starting a business need to meet to receive loans depend on where they seek funding. At the bare minimum, the firm must be at least 51% owned and run by a military veteran, qualifying spouse, or active duty service member.

If you’re seeking funding from a FinTech marketplace or online lender, you can be eligible for veteran-owned business loans and grants if you meet these conditions:

- 685 credit score

- Six months of business history

- $10,000 in monthly gross income

But don’t forget that SBA has stricter veteran-owned franchise loan qualifications. To receive an SBA loan, the company must meet these requirements:

- A credit score of 685 or more: The Small Business Administration only works with companies with a proven history of paying on time and consistently. Remember that the higher your personal credit score is, the more likely you’ll get approved for a veteran business loan and the more likely you’ll get favorable interest rates.

- Two years of business history: Veteran business loans, especially those provided via an SBA program, require a business to have at least two years of business history. Often, younger businesses are deemed as riskier than older ones.

Besides the veteran-owned franchise loan requirements mentioned above, the Small Business Administration will also ensure that:

- Your company is not a Ponzi scam, lending, or gambling business.

- Your business meets the SBA’s size requirements for startups

- Your firm is located and operated within the US.

- You and your partners have adequate invested equity

- Your company can show projected positive cash flow for two years

- Both you and your partners aren’t criminals on any debt obligations to the United States government, including student loans

- All business owners with 20% or more ownership meet the SBA’s character requirements–persons convicted of certain crimes are prohibited.

Top Sources of Business Loans for Veterans

The SBA and SBA-approved banks and credit unions provide funding for veterans. Let’s discuss their top programs for military veterans below.

SBA Veteran Advantage Loans

This veteran business loan is available through SBA-approved lenders. The SBA guarantees lenders approximately 85% of the loan amount, reducing your risk of failing to pay the loan.

The 7 (a) is one of the most popular veteran business loans, which offers funding for various business expenses. This funding option provides low interest rates and long terms; you can receive up to $5 million. Also, lenders can reduce or waive all fees for veterans. However, you may have to fill out a ton of paperwork.

To qualify for the SBA Veteran Advantage Loan, you must meet the SBA size standards, prove your ability to repay the loan by proving you have adequate cash flow, and have good business and consumer credit.

SBA Express Loans

If you’re a military veteran or a qualifying spouse, you might be eligible for fee discounts on the SBA Express Loan. Currently, veterans don’t pay upfront fees on these veteran business loans.

This type of SBA 7(a) loan is capped at $500,000 and has ten-year terms. However, it’s crucial to note that SBA Express Loans often have higher interest rates than 7(a) loans because the government guarantees a smaller loan amount.

To be eligible for the fee relief, your firm must be at least 51% owned by someone who falls in one of these categories:

- A service-disabled veteran

- A military veteran who didn’t receive bad conduct or dishonorable discharge

- A reservist or National Guard member

- An active-duty service member in the Transition Assistance Program

- A current spouse of any of the above or whose spouse passed away while in military service or of a service-related disability.

Military Reservist Economic Injury Disaster Loan (MREIDL)

This veteran small business loan offers low-interest loans, especially when an “essential worker” is called up for active duty in the National Guard or Reserve. The SBA’s MREIDL offers up to $2 million to allow business owners to cover operating costs they would have been able to pay if the employee hadn’t been called up.

Credit Unions and Banks

Many credit unions and banks provide small business loans to military veterans and other business owners. Although banks have more stringent qualifications, the APR range is more competitive compared to what online lenders offer.

Some banks, like Huntington Bank, offer military veterans discounted interest and fees. You can also apply for veteran commercial business loans through credit unions that cater to military veterans, including the Navy Federal Credit Union.

Grants for Military Veterans

Business loans are often risky. Your personal and business credit scores could plunge if you default on the loan, so you must be cautious with this type of funding.

Grants are a better alternative to small business loans because you don’t have to repay them, and they have no impact on your credit score. Organizations such as Second Service Foundation and Warriors Rising provide various business grants for military veterans.

However, it’s crucial to note that grants are very competitive, and funding timelines are often longer.

How to Apply for Veteran Business Loans

Like other types of small business funding, those who qualify for veteran entrepreneur loans must gather and submit various documentation with their application. Besides the usual types of documents–like financial statements, business plans, general business ownership information, tax information, and any other relevant certifications or licenses–military veterans and their spouses also must provide specific forms that prove military service histories:

- Service-disabled military veterans must provide a copy of Form DD 214 or documents proving they have a service-connected disability.

- Military veterans must provide a copy of Form DD 214.

- Transitioning active-duty service members must provide a copy of DD Form 2, “Armed Forces of the U.S. Geneva Conventions Identification Card (Active),” DD Form 2 “United States Armed Forces Identification Card (Active)” and DD Form 2648-1 (Reservist) or DD Form 2648 (active-duty service members).

- Current spouses of military veterans must provide Form DD 214 and documents proving they are the current spouses of military veterans.

- National Guard and Reserve members must provide DD Form 2, “Armed Forces of the U.S. Identification Card (Reserve).”

- Current spouses of transitioning active-duty service members of current National Guard/reservists must provide DD Form 1173, evidence they’re the current spouse, and a Department of Defense Guard Reserve Family Member Identification Card.

- Widows of veterans who died in the line of duty or from injuries suffered while serving must provide documents from the Department of Veterans Affairs or the Department of Defense proving that it’s true.

If Form DD 214 is unavailable, you can use NA Form 13038 as an alternative documentation.

After submitting all relevant documents, an SBA lender—like other lenders—will most certainly check your personal credit score to establish your creditworthiness. Sadly, this inquiry can lower your credit score, making it difficult to get funded if the SBA doesn’t approve your application.

Tips on Managing Veteran Business Loans

You worked to scale your business and applied for a veteran-owned franchise loan. Then you get approved. So what’s next? After finding the right veteran business loan and receiving the funds, you need a plan to manage loan payments.

To avoid loan default, you must know how to manage your budget and business loan and what to do if you run into a financial crisis.

- Refinance if Necessary

Refinancing your veteran entrepreneur loan can help you take advantage of the changing situation and save money on the loan. Refinancing makes sense if you have favorable interest rates or your personal and business credit scores have improved significantly since securing the loan.

It doesn’t make sense if business loan fees outweigh the money you’d save from the refinance. Thus, if you’re considering refinancing your business loan, calculate every expense to establish if it suits your business.

- Prioritize Loan Payments in Your Budget

A budget is a calculated plan that helps small businesses manage money, including expenses and income. Once you sign a business loan agreement, note the monthly payment amount. Then, plan how to set that money aside and prioritize it above less essential expenses in your budget.

- Monitor Your Spending

Meticulous bookkeeping can help you understand your cash flows across different seasons and months. You can now use that information to create a loan repayment strategy. Also, it allows you to use loan funds effectively and avoid mixing spending categories. If this is your first time managing a veteran business loan with regular funds, start by opening separate business accounts, monitoring your receipts, working with an accountant, and using accounting software or spreadsheets to organize your funds. This will also help you stay on top of accounting and avoid defaulting on your loan.

Managing your veteran-owned business loan is less challenging when you know what you’re doing. Monitoring your finances and prioritizing loan payments in your budget are the keys to sustainable growth within your business and successful loan management.

Conclusion: Veteran Business Loans

There are many loan options for veteran-owned franchises needing financial support without maxing out any credit cards in the process. Veteran startup business loans are vital, but ensure you research and understand the fine details before making any commitments.

To get the most accurate and credible veteran disability rating, take our quiz now!

Veteran Business Loans FAQs

How does a Veteran Business Loan work?

Veteran-owned business loans help military veterans start or operate businesses. Government agencies often help veterans get financially organized before connecting them with potential lenders. Loan recipients might have to pay a fee upfront to secure the loan, followed by monthly interest rates for a specific timeframe.

Can I qualify for a Veteran small business loan with bad credit?

While you won’t receive the best monthly interest rates, getting a business loan is possible even with a bad credit score. Before choosing the right lender for your business, compare interest rates, loan terms, and fees.

Does the VA provide business loans and grants?

The VA doesn’t provide small business loans and grants. Instead, its website directs military veterans to the SBA’s offers.

How much money can I get for a veteran business loan?

Veteran-owned businesses can get up to $2 million via the MREIDL.

What are the fees on Veteran-startup business loans?

Apart from interest rates, potential fees on SBA 7 (a) financing include upfront and annual service fees.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.