Property tax exemptions for veterans can be a complicated subject to comprehend, but since it impacts a critical demographic group who have dedicated their lives to serving their country, it is an important one. Tax exemptions in this context refer to the alleviation of the financial burden often associated with owning property—especially for those who may be on fixed or decreased incomes due to retiring from active service. So, are there states with no property tax for veterans?

The Importance of Tax Exemptions for Veterans

The provision of meaningful tax breaks, like property tax exemptions, can help safeguard the financial security of veterans and ensure that owning a home does not become a financial strain but remains a tangible sign of their commitment to their nation. Thus, it is crucial on both a micro and macro level, affecting the individual and the broader disabled veteran community.

Property Tax and Its Exemptions

In the United States, property tax is a levy applied by government entities, usually local or county governments, based on the assessed value of a real estate property. The tax collected is typically used to fund local public utilities and services, such as schools, roads, and law enforcement.

In simple terms, a tax exemption reduces the overall tax bill. Tax relief implies that its owner is either exempt from paying property tax entirely or required to pay a reduced amount.

For veterans, these exemptions usually result from the recognition that service members may face unique financial burdens due to their military service. These burdens can make it more challenging for a disabled veteran to sustain homeownership if no tax relief is applied.

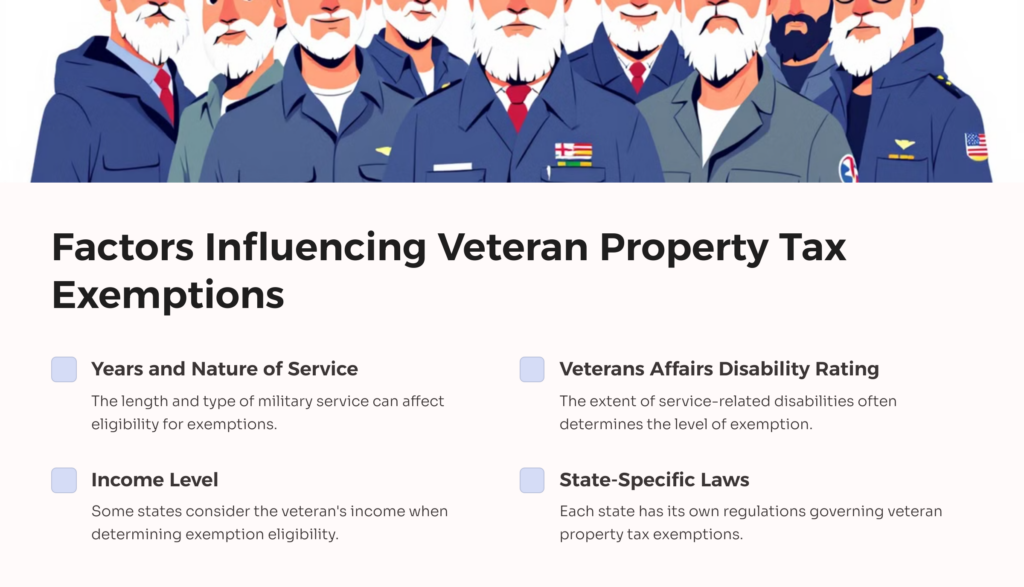

Factors Influencing Property Tax Exemptions for Veterans

Various factors determine the nature and extent of tax exemptions provided to veterans. These include years and nature of service, Veterans Affairs disability rating (if any), income level, and state-specific laws and regulations.

Understanding these factors is essential as they directly impact eligibility and the level of exemptions. Hence, veterans must be knowledgeable about these factors to make the most of the benefits available to them.

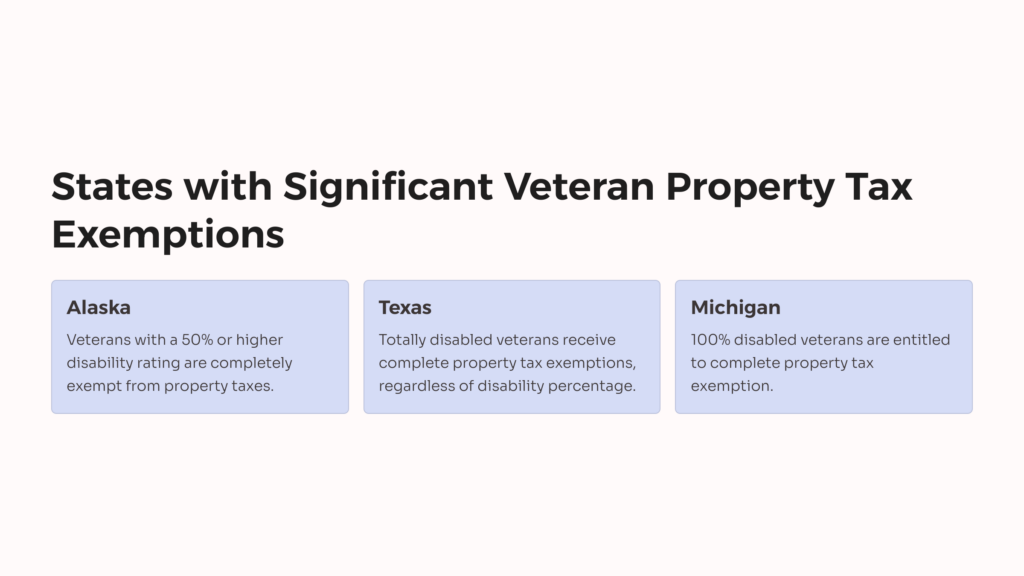

3 States with Veteran Property Tax Exemptions

While state benefits vary, some states will provide full property tax relief to an eligible veteran. These states have been included based on their broad veteran-friendly property tax relief laws, which usually cover all veterans or those who meet specific service-related or disability criteria.

State 1: Alaska

For instance, in Alaska, veterans with a 50% disability rating or more due to their service are completely exempt from paying property taxes.

State 2: Texas

Similarly, in Texas, a totally disabled veteran can receive complete property tax exemptions regardless of the percentage of their disability.

State 3: Michigan

In Michigan, veterans who are 100% disabled from service are entitled to complete property tax exemption.

Comparison of these States

Although the degree of disability determines the level of tax exemption in these states, the common thread is that they recognize both the sacrifices made and the increased financial burden often accompanying service-related disabilities.

Benefits of Property Tax Exemption for Veterans

The gains that come from property tax exemptions materialize in both immediate and long-term benefits to veterans.

The most significant immediate aid is the financial relief that comes with exemptions or reduced property tax. This reduction can free up resources for other critical areas of expenditure for veterans.

In the long term, the savings accrued from tax exemptions can contribute to financial stability and secure retirement, especially for those on fixed incomes or limited disability benefits.

Beyond individual financial benefits, veteran property tax exemptions recognize and honor the service to the country, thereby enhancing the morale of the broader veteran community.

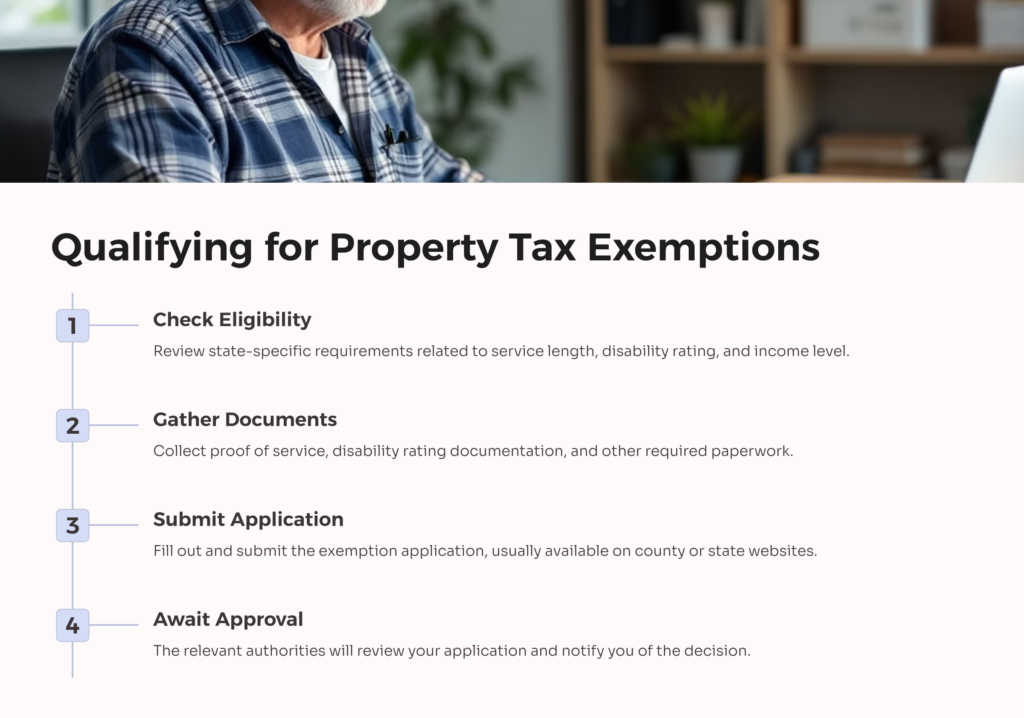

Qualifying for Property Tax Exemptions as a Veteran

The qualifications for a property tax exemption vary depending on state laws, but there are commonalities in many regions.

The general prerequisites for exemptions are often related to the length and nature of service, the extent of disability, and the income level of the veteran. The disabled veteran may need a certain disability rating from the United States Department of Veterans Affairs.

Applying for Exemption

Typically, applying for an exemption involves filling out and submitting an application, usually available on county or state websites, along with supporting documents that prove eligibility. The application may include tax information like the standard income tax amount for the tax year, and information about their military service connected disability.

Useful Resources for Veterans

It’s always advisable for veterans seeking benefits to consult with veteran service organizations and tax consultants. Most states also have Veteran Affairs offices to assist veterans in understanding and accessing their benefits. Some useful online resources include the American Legion and Veterans of Foreign Wars websites.

Understanding the ins and outs of property tax exemptions for veterans is crucial given its potential impact on their financial well-being and their access to homeownership—our veterans deserve no less. Take our free medical evidence screening and get started today at AllVeteran.com.

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.