A Comprehensive Overview for Veterans

I. Introduction

Veterans Affairs (VA) benefits are a key part of the resources provided by the United States government to those who have served in the military. The purpose of these benefits is not only to honor and respect the services rendered by the veterans but also to ensure their overall well-being after their time on active duty. They cover a broad range of services including disability payment, compensation, pension, education and training, health care, home loans, insurance, and burial benefits. But one major question always looms in discussions around VA benefits: Are these benefits taxable? The answer to this is critical in helping veterans better plan their personal finance options post-service.

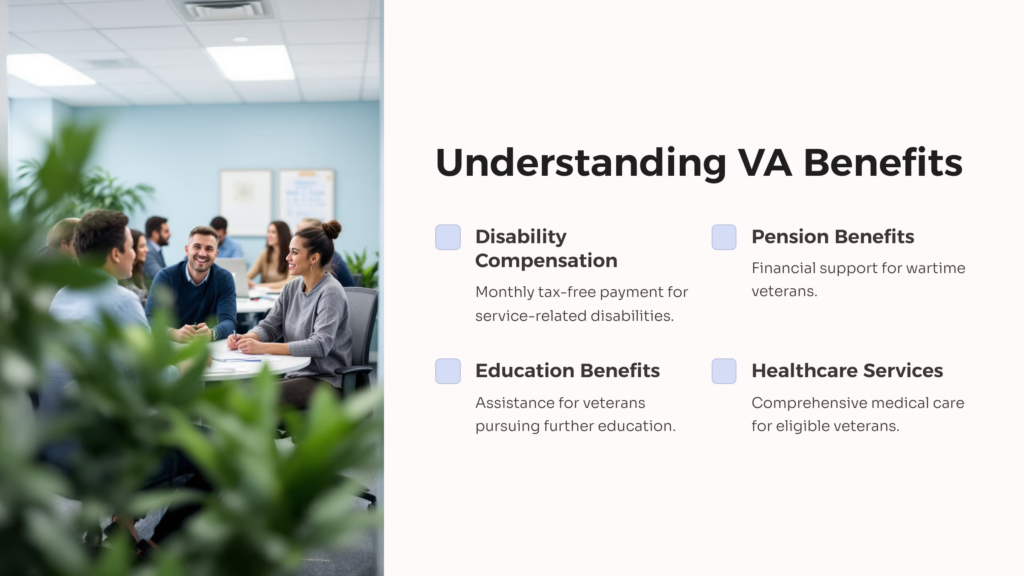

II. Understanding VA Benefits

VA benefits, as per the United States Department of Veterans Affairs, are facilities and services given to honorably discharged veterans who meet certain eligibility criteria. These benefits vary significantly in nature. Some classically recognized VA benefits are disability compensation, a monthly tax-free payment to disabled veterans who got sick or injured while in military service; pension benefits for wartime veterans; and education benefits for veterans looking to further their education. Given this range, the breadth of VA disability benefits goes a long way in supporting veterans and their families. However, their applicability hinges on the veterans’ service records and disability statu among other factors.

III. General Overview of Taxable and Non-Taxable Income

Income, for the most part, can be broadly categorized as taxable income or non-taxable income. Taxable income refers to the income on which the tax is legally levied by the government. It includes salaries, business income, gains from trading and investments, etc. On the other hand, non-taxable income is the portion of an individual’s total income that is not subject to taxes. This could include certain types of gifts, inheritances, workers’ compensation, welfare benefits, and, notably, certain VA benefits. Distinguishing between taxable and non-taxable income is crucial for filing accurate tax returns and avoiding potential legal issues.

IV. Are VA Benefits Taxable?

As we navigate the maze of income tax laws, let’s clarify the tax status of VA benefits. Under Title 38 of the U.S. Code § 5301, VA benefit, in general, is not considered taxable income. This means there is a tax exemption from benefits received through VA programs, nor are they required to report their benefit information when filing their federal income tax returns. However, it’s crucial to understand that some VA benefits might be deemed taxable under specific conditions. If a veteran, for example, sells a home purchased through a VA loan and makes a profit from the sale, there may be capital gains tax implications.

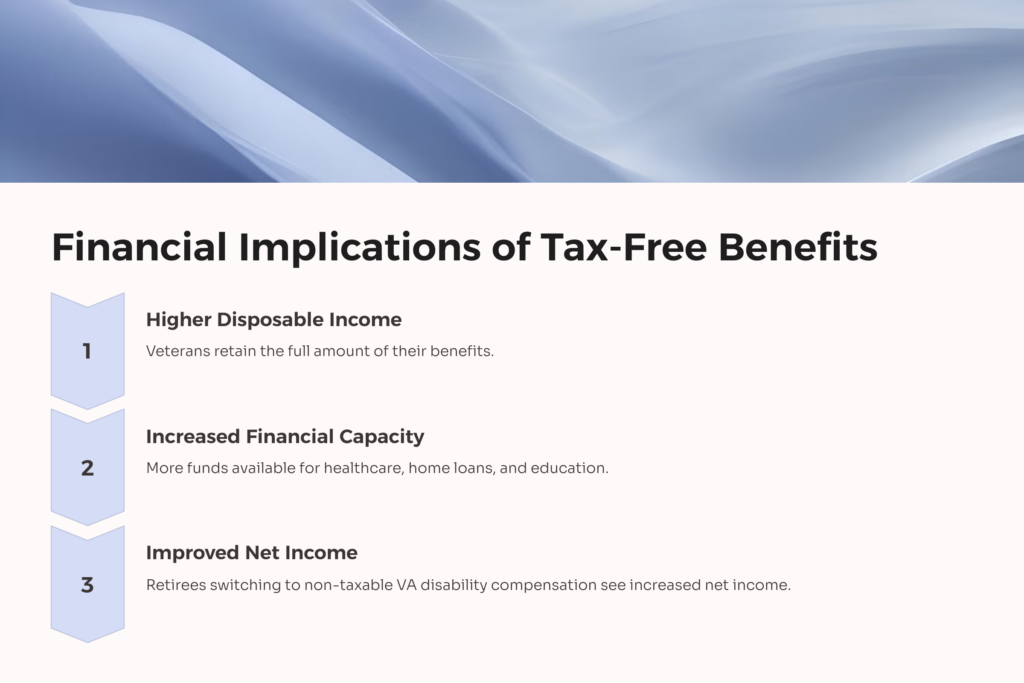

V. Implications of Tax Exemptions for VA Benefits

Tax exemption and VA benefits carry substantial financial implications for veterans. Firstly, tax-free benefits allow veterans to retain the entirety of their benefits, resulting in a substantially higher disposable income. This is particularly critical for veterans who rely on these benefits as their primary source of income. Moreover, it allows for an increased financial capacity to cater to essentials such as healthcare needs, home loans, and even educational pursuits for a better future. This is best exemplified by retirees who shift from a taxable military retirement pay to a non-taxable VA disability compensation, consequently increasing their net income.

VI. Frequently Asked Questions About Taxation and VA Benefits

The taxation of VA benefits can be a confusing topic for many, leading to common misconceptions and questions. One frequent question is if disability pensions are taxable. As per IRS guidelines, VA disability pensions are indeed not taxable. Another common query is about the tax implications if VA benefits are the only form of income. Here, it’s important to note that as VA benefits aren’t considered taxable income, they do not contribute towards the minimum income required to file a tax return.

VII. Conclusion

In conclusion, understanding the tax implications of VA benefits is critical for a veteran to effectively manage their personal finance decisions. Broadly, VA benefits have a tax exemption, providing financial security to veterans across the country. However, specific situations may pose different tax implications, reinforcing the necessity for veterans to closely monitor their financial affairs. While this article provides a broad overview, it’s recommended that veterans consult a tax professional, accounting service, or a Veterans Service Office for personalized advice.

Remember, knowledge is every veteran’s key to unlocking a financially secure future. Use these resources, consult professionals, and utilize VA benefits and any VA compensation to their full extent – you’ve earned them!

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.