Veterans who have service-connected disabilities are eligible for monthly compensation from the Department of Veterans Affairs (VA). These rates are updated each year with the COLA (Cost of Living Adjustment) to keep up with economic conditions.

In 2026, rates will go up by 2.8%.

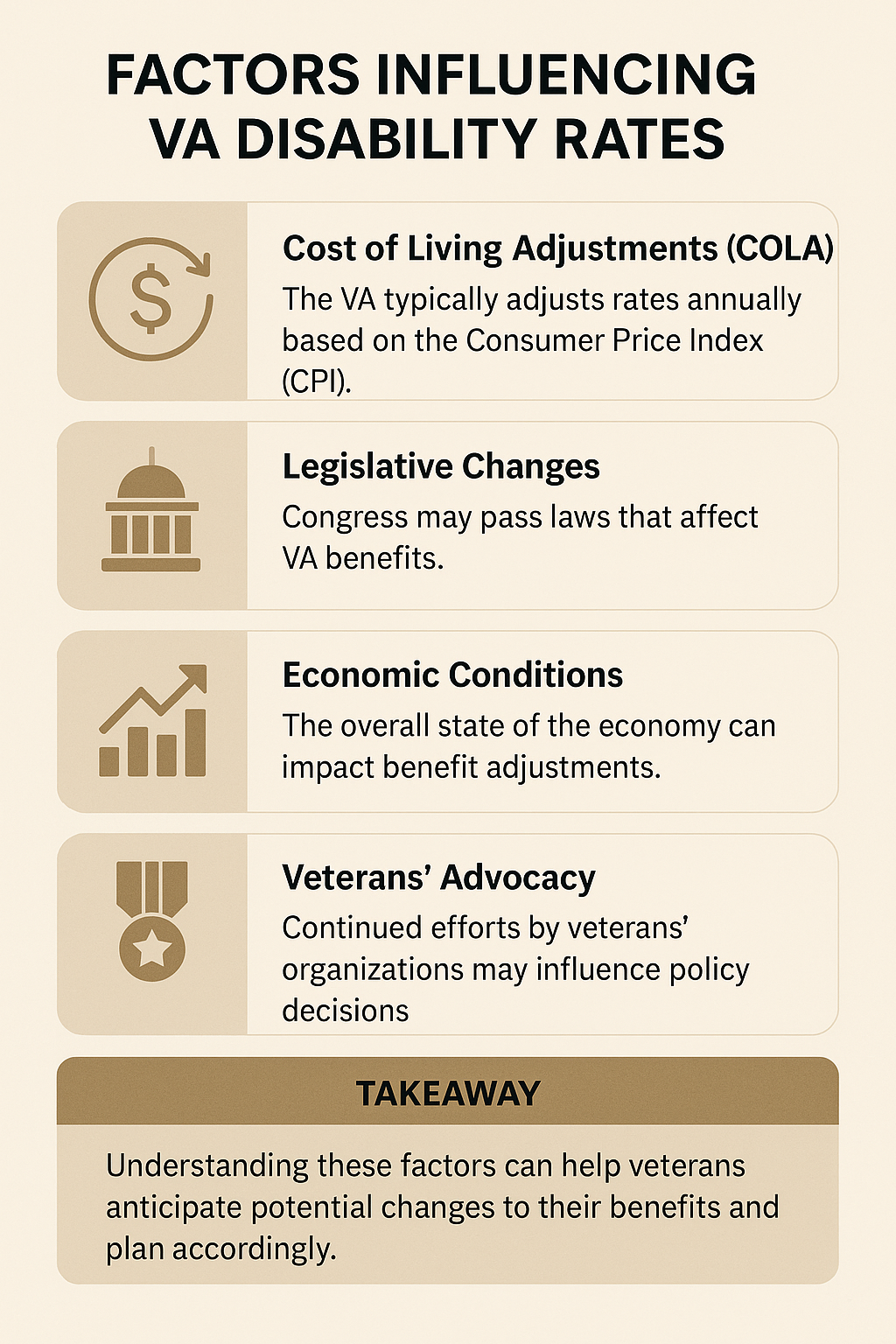

Factors Influencing VA Disability Rates

Several key factors influence the VA disability compensation rates:

- Cost of Living Adjustments (COLA): The VA typically adjusts rates annually based on the Consumer Price Index (CPI). This ensures that benefits keep pace with inflation and the overall cost of living.

- Legislative Changes: Congress may pass laws that affect VA benefits, potentially leading to increases or changes in how rates are calculated.

- Economic Conditions: The overall state of the economy can impact government spending and benefit adjustments.

- Veterans’ Advocacy: Continued efforts by veterans’ organizations may influence policy decisions regarding disability compensation.

Understanding these factors can help veterans anticipate potential changes to their benefits and plan accordingly.

Disability Compensation Rates for 2026

Here are the rates for 2026, effective as of December 1, 2025. These were calculated by the VA based on this year’s increase of 2.8%:

Percentages 10-20:

- 10% disability rating: $180.25 per month

- 20% disability rating: $356.32 per month

Rating Chart: Percentages 30-60

| Dependent Status | 30% Rating | 40% Rating | 50% Rating | 60% Rating |

| Veteran alone | $551.93 | $795.06 | $1,131.79 | $1,433.62 |

| With spouse | $617.19 | $882.44 | $1,241.27 | $1,565.20 |

| With spouse, 1 parent | $669.83 | $951.91 | $1,328.64 | $1,670.47 |

| With spouse, both parents | $722.46 | $1,021.39 | $1,416.02 | $1,775.74 |

| With 1 parent | $604.62 | $864.54 | $1,219.17 | $1,538.88 |

| With both parents | $657.20 | $934.02 | $1,306.54 | $1,644.15 |

| With 1 child | $595.09 | $852.96 | $1,204.43 | $1,520.99 |

| With child and spouse | $665.62 | $946.65 | $1,321.28 | $1,660.99 |

| Each additional child under 18 | $32.63 | $43.16 | $53.69 | $65.27 |

| Each additional child under 18 in qualifying school program | $60.00 | $80.00 | $100.00 | $120.00 |

| Spouse receiving aid and assistance | $60.00 | $80.00 | $100.00 | $120.00 |

Rating Chart: Percentages 70-100

| Dependent Status | 70% Rating | 80% Rating | 90% Rating | 100% Rating |

| Veteran alone | $1,806.69 | $2,100.10 | $2,360.00 | $3,934.74 |

| With spouse | $1,959.32 | $2,274.84 | $2,556.85 | $4,154.12 |

| With spouse, 1 parent | $2,082.49 | $2,414.85 | $2,714.75 | $4,330.19 |

| With spouse, both parents | $2,205.65 | $2,554.85 | $2,872.66 | $4,506.26 |

| With 1 parent | $1,929.85 | $2,240.10 | $2,517.90 | $4,110.81 |

| With both parents | $2,053.01 | $2,380.10 | $2,675.81 | $4,286.88 |

| With child | $1,908.79 | $2,216.94 | $2,491.59 | $4,081.45 |

| With child and spouse | $2,071.96 | $2,403.27 | $2,701.07 | $4,314.78 |

| Each additional child under 18 | $75.79 | $88.32 | $97.90 | $109.00 |

| Each additional child under 18 in qualifying school program | $246.33 | $281.06 | $316.86 | $352.11 |

| Spouse receiving aid and assistance | $141.06 | $161.06 | $181.06 | $201.21 |

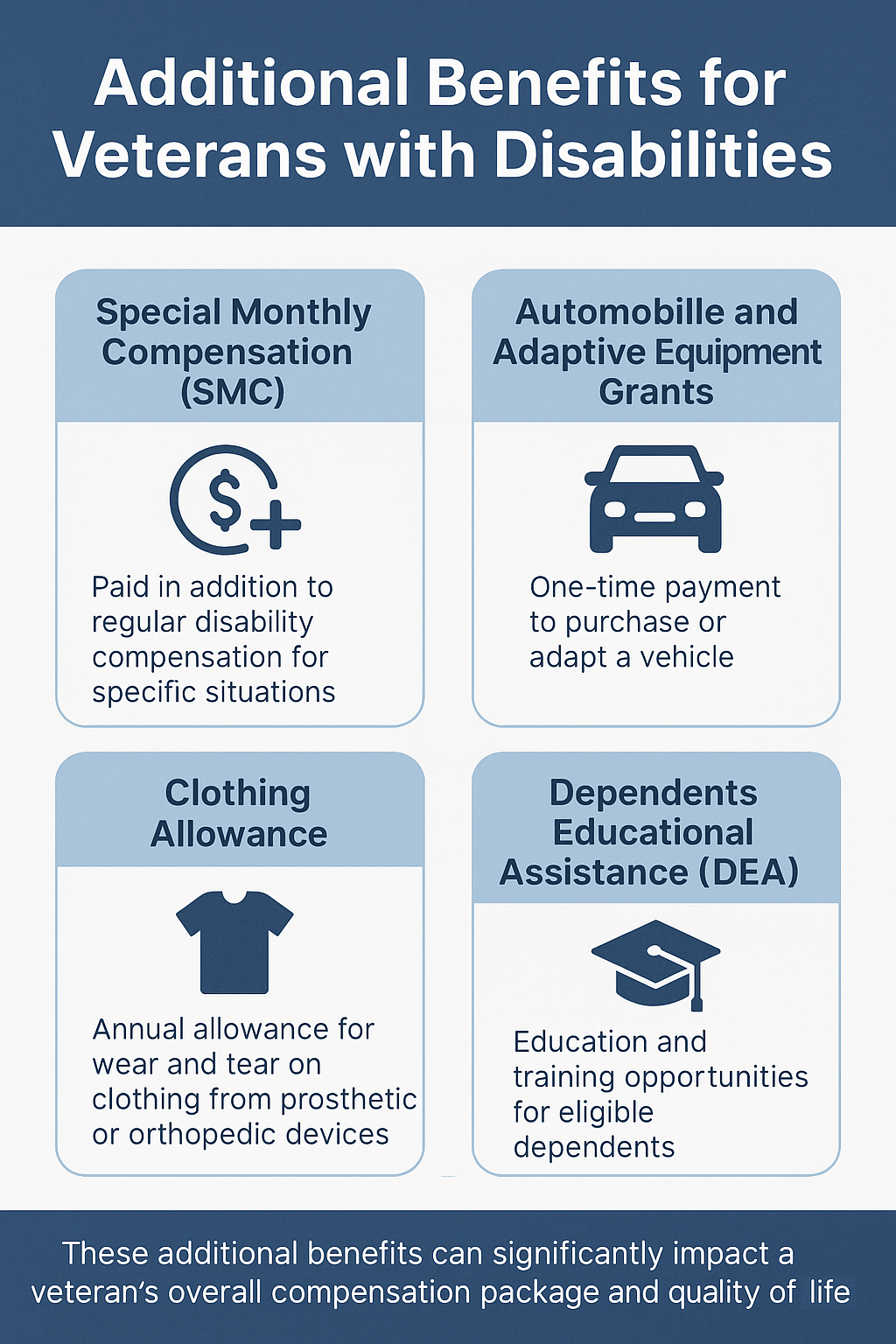

Additional Benefits for Veterans with Disabilities

In addition to the basic compensation rates, veterans with certain severe disabilities may be eligible for additional benefits. These include:

- Special Monthly Compensation (SMC): This is paid in addition to the regular disability compensation for specific situations, such as the loss of use of a limb or the need for regular aid and attendance.

- Automobile and Adaptive Equipment Grants: Veterans with certain disabilities may qualify for a one-time payment to help purchase a vehicle or adapt an existing one.

- Clothing Allowance: An annual allowance is available for veterans whose service-connected disability requires the use of a prosthetic or orthopedic device that tends to wear out clothing.

- Dependents Educational Assistance (DEA): This program offers education and training opportunities to eligible dependents of veterans who are permanently and totally disabled due to a service-connected disability.

These additional benefits can significantly impact a veteran’s overall compensation package and quality of life.

How to Prepare for 2026 VA Disability Rates

Veterans can take several steps to prepare for potential changes in their disability compensation:

- Stay Informed: Regularly check the VA’s official website and communications for updates on benefit rates and changes.

- Review Your Rating: If your condition has worsened, consider applying for an increased disability rating.

- Update Your Information: Ensure the VA has your current contact and dependent information to avoid delays in benefit adjustments.

- Seek Professional Advice: Consult with a Veterans Service Officer or financial advisor to understand how changes may affect your overall financial planning.

- Explore Additional Benefits: Research and apply for any additional benefits you may be eligible for based on your disability rating and circumstances.

By taking these proactive steps, veterans can better position themselves for any changes in the 2025 VA disability compensation rates.

Impact of 2026 Rates on Veterans’ Lives

The increase in VA disability compensation rates for 2026 could have a significant impact on veterans’ lives. Higher rates may:

- Improve financial stability for disabled veterans and their families

- Allow for better access to healthcare and necessary accommodations

- Provide more resources for vocational rehabilitation and education

- Reduce financial stress and improve overall quality of life

However, it’s important to remember that individual circumstances vary, and the impact of rate changes will differ for each veteran based on their specific situation and needs.

Staying Informed Makes All the Difference

We believe that staying informed and prepared is crucial for veterans. The projected increases reflect the ongoing commitment to supporting disabled veterans and their families. As we move into 2025, veterans should continue to advocate for their rights, stay engaged with the VA, and seek assistance when needed to ensure they receive the full benefits they’ve earned through their service and sacrifice.

Our goal is to help you—stay informed and find your disability rating with our help at Allveteran.com. You can begin today by taking our free medical evidence screening!

AllVeteran.com Advisors

AllVeteran.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.